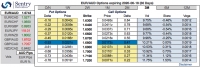

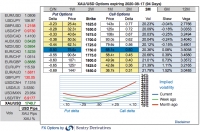

FxWirePro: Bullish/Bearish Driving Forces, OTC Indications Of EUR/AUD And Suitable Options Strategy

May 19, 2020 10:56 am UTC| Research & Analysis Insights & Views

Bearish EURAUD Scenarios: 1) A second Covid-19 wave that does further damage to public finances. 2) Continued failure of Euro area governments to agree joint fiscal issuance or material fiscal transfers to fund...

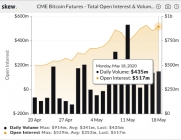

May 19, 2020 07:37 am UTC| Research & Analysis Digital Currency Insights & Views

The underlying price of bitcoin gained buying momentum ahead of fundamental block-halving event. At block 630,000 the block reward of mining a block on the Bitcoin network reduced from 12.5 BTC to 6.25 BTC completing its...

May 19, 2020 06:44 am UTC| Research & Analysis Digital Currency Insights & Views

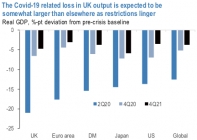

As the total reported death cases exceeds day by day due to the deadly contagious coronavirus, almost all businesses have halted as the major markets have been locked down. The Economist Intelligence Unit reckons the...

May 18, 2020 13:17 pm UTC| Research & Analysis

Another month into the Covid-19 lockdown and it seems to us to that GBP is in a rather more vulnerable position than was the case a month ago. This stems from the potential permanent economic scaring from Covid-19 that is...

May 15, 2020 14:07 pm UTC| Research & Analysis Central Banks Insights & Views

The US Aprilretail saleshas disappointed a day of important releases. The US data (retail sales -16.4%, industrial production -11.2%, Empire Index -48.5%) might fuel global economic concerns on the markets again. Even if...

May 15, 2020 13:34 pm UTC| Research & Analysis Insights & Views

The gold price is edging above $1,732 levels which is on the verge of 8-years highs, the yellow metal gains considerably from the last couple of days, especially after the lows of $1,455 levels. Weve discussed both bullish...

FxWirePro: A Bird’s Eye-View On RBA QE Program And AUD Risk-Reversals - Hedging & Trading Setup

May 15, 2020 11:14 am UTC| Research & Analysis Central Banks Insights & Views

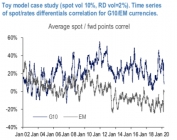

Markets would be observing the effectiveness of the RBAs QE program and yield target. A fair level for 3yr swap rates would be around 0.40%, but pandemic-related volatility will result in a wide range, say 0.25%-0.50%. The...

- Market Data