The underlying price of bitcoin gained buying momentum ahead of fundamental block-halving event. At block 630,000 the block reward of mining a block on the Bitcoin network reduced from 12.5 BTC to 6.25 BTC completing its third successful halving. This fundamental event is perceived as quantitative measure as Bitcoin’s set supply cuts every 210,000 blocks are “all about the selling pressure” according to Mike. With miners having fewer coins to sell in the market (assuming miners do sell all their BTC) the supply will reduce as well.

Consequently, the underlying price of bitcoin has resumed its bullish business, BTCUSD surged 9,957 levels.

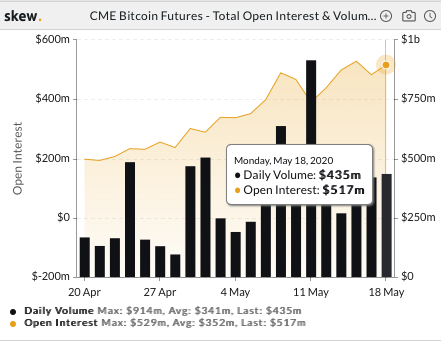

Yet another prime factor driving more steady recent price and supply conditions for Bitcoin is sluggish futures market. Open Interest (OI) of bitcoin options and futures data has been risen considerably (refer above charts).

Although the aggregated OI for leveraged futures contracts on platforms like Bitmex and Binance has plunged since the halving event as the speculators have been dubious about betting on the halving’s price effects at that juncture.

To be precise, open interest is the total number of contracts held by market participants. Visualize a scenario where $70 million worth of call options are traded one week. Both the holder and writer of the option would be squaring off their positions and risk. Consequently, open interest (market exposure) for such a scenario would be zero despite $140 million being traded.

However, for now, both OI and volumes data has shown recovery decisively. The long hedges have already been advocated using CME BTC Futures about 2-months ago. In addition, 1m ITM call options have also been recommended. These positions have been functioning as per our expectations so far, if we keep speculating on the next upside target and accumulate fresh bitcoins, it would be unwise. Instead, one can certainly uphold the above-advocated long hedges as the underlying price is staged for the 2nd consecutive months’ recovery and most likely to prolong the upside risks. Courtesy: skew & tradingview

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?