Another month into the Covid-19 lockdown and it seems to us to that GBP is in a rather more vulnerable position than was the case a month ago. This stems from the potential permanent economic scaring from Covid-19 that is only now starting to become apparent, the attendant hit to public-sector finances, and the additional pressure on the BoE to provide monetary financing for this. If all of that were not bad enough, investors still have Brexit to contend with and GBP could be exposed to a fraught few months if the UK government follows-though on its stated intention and fails to extend the Brexit transition period by the end-June deadline. In that event, investors would probably need to price a no trade deal Brexit at the end of this year as a 50:50 possibility, and potentially even as the central scenario. In view of all of these factors we are lowering our GBP forecast by roughly 2% – 1Y cable is now 1.20 from 1.23 previously and EURGBP is put at 0.88 from 086.

To be clear, these numbers do not include a no deal outcome as the central scenario, and so there is still quite a bit of downside risk in the event that no extension or no trade deal is forthcoming (cable would retest the recent 1.15 low in that scenario, we suspect).

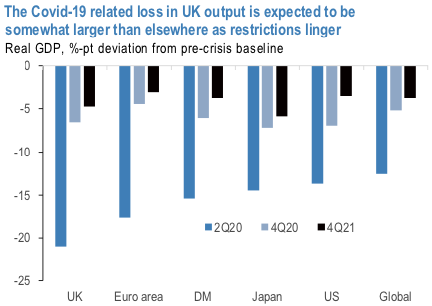

The economic outlook remains uncertain and fluid of course, not least because the government has yet to articulate a clear plan to re-open the economy, and even then such plans are subject to the whims of the Covid-19 virus itself. But on their current assessments our economists expect the UK to suffer a slightly larger net output loss as a result of the crisis than its peer group, with the level of GDP projected to be nearly 5% lower than the pre-crisis baseline by the end of 2021. This compares with losses of 3-3.5% for the Euro area and US (refer above chart).

In addition, the damage to UK public finances will be quite a bit worse than initially assumed, not least because of the scale and open-ended duration of the government’s furlough scheme that is now paying one-in-every four private sector workers. The budget deficit is now projected at 16% of GDP - this may not be the worst in G10 (the US is expected to push 20%), but is certainly larger than most.

Our defensive stance in EURGBP has been dictated by the receding global economic tide, but we cannot ignore that political risk has been an instrumental factor in these worse macro outturns. This warrants a tactical reduction in our defensive exposure but we uphold our hedging portfolios via 3-way straddles.

Let’s just quickly glance at OTC updates & suitable options strategy:

The positively skewed IVs of 3m tenors are well-balanced, indicating both upside and downside risks, more bids are observed for OTM call strikes up to 0.9150 levels.

While EURGBP risk reversals of the existing bullish setup remain intact as fresh bids for bullish risks have been added across all tenors.

Below options strategy could be deployed amid the expected turbulent conditions. According to the OTC FX surface, 3-way options straddle versus ITM puts seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of buying at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM put option of 2w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentry, Saxo & JPM

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges