Bearish EURAUD Scenarios:

1) A second Covid-19 wave that does further damage to public finances.

2) Continued failure of Euro area governments to agree joint fiscal issuance or material fiscal transfers to fund economic rebuilding.

3) Italy loses investment grade status.

4) UK leaves the EU at year-end with no trade deal. 5) GCC blocks Bundesbank participation in QE.

5) The bulk commodity prices remain elevated and Chinese growth numbers validate the v-shape recovery.

Bullish EURAUD Scenarios:

1) Political progress towards debt mutualisation and/or more significant fiscal transfers as part of the recovery plan.

2) All countries tap the ESM facility and the ECB stands ready to activate the OMT facility.

3) ECB aggressively expands PEPP in support of peripheral markets.

4) The UK extends its transition period for Brexit beyond end-2020.

5) China-Australia trade tensions continue to escalate;

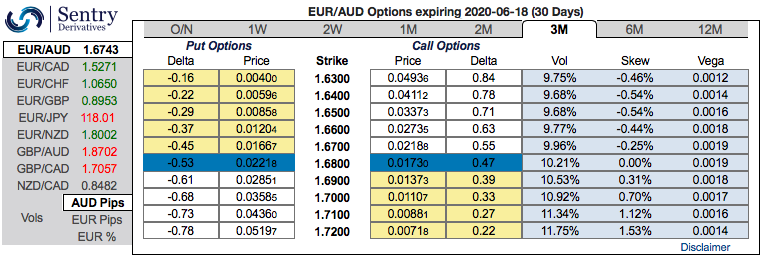

OTC Indications and Options Strategy: Please be noted that IV skews of EURAUD are stretched on either side, the positively skewed IVs of 3m tenors are signifying more hedging interests in bullish risks (refer above exhibit). More bids for OTM call strikes of 1.72 levels of this tenor.

Contemplating fundamental and OTC factors as explained above, although it is sensed that all chances of Aussie dollar looking superior over Euro in the near term and vice versa in the medium-term future; we advise to hedge the puzzling swings through below options recommendations.

The execution: Spot reference: 1.6740 levels, buy 2 lots of at the money 0.51 delta call option of 3m tenor and simultaneously, buy at the money put option of 1m tenors. The option strap is more customized version of straddles but instruments slightly biased bullish risks. Courtesy: Sentry & JPM

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025