The gold price is edging above $1,732 levels which is on the verge of 8-years’ highs, the yellow metal gains considerably from the last couple of days, especially after the lows of $1,455 levels. We’ve discussed both bullish as well as bearish driving forces, OTC indications and options strategy of this precious metal price trend.

Bullion’s Bullish Scenarios:

- Investor demand for gold surges as equity volatility fades and rates remain low;

- Inflation comes in hotter than expected working to boost inflation expectations and further lower real yields;

- The US dollar weakens dramatically as other countries rebound quicker from the recession;

- Asian physical buying sharply picks up.

Bullion’s Bearish Scenarios:

- Global economic growth momentum recovers much stronger and earlier than expected sending US Treasury yields higher;

- Extreme equity volatility returns with gold being sold once again to raise cash;

- Central banks actually begin selling gold amid high prices and soaring budget deficits;

- Inflation expectations drop amid a prolonged economic slowdown driving real yields higher.

OTC Updates And Hedging Strategies:

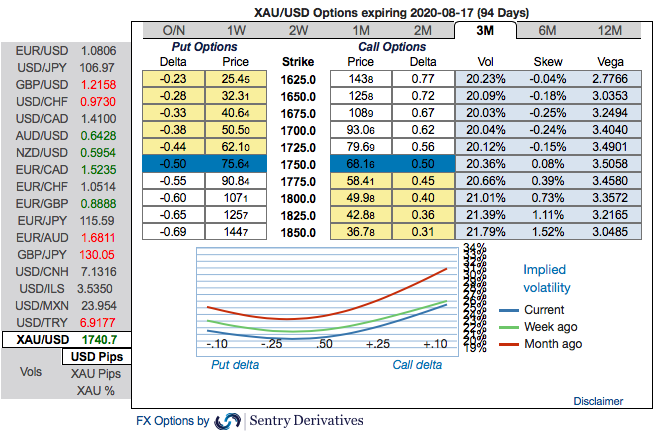

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,850 is quite evident that reminds us hedgers’ inclination for the upside risks.

The fresh bids for the existing bullish risk-reversal setup substantiates the above-mentioned bullish hedging sentiments, these risk reversal (RRs) numbers also indicate the overall upside risk environment (2ndnutshell).

Capitalizing on all the above fundamental factors and the price trend, we advocated longs in gold via ATM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on both trading and hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying. Courtesy: Sentry, JPM and Saxo

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings