Jan 25, 2018 09:05 am UTC| Central Banks Research & Analysis Insights & Views

When pondering about the ECBs monetary policy meeting today, a proverb strikes our mind: if the mountain wont come to Mohammed. This seems to be exactly ECB President Mario Draghis approach. Despite weeks and weeks of...

FxWirePro: How does dollar look when all eyes on ECB and Davos? Snippets of FX options space

Jan 25, 2018 08:08 am UTC| Central Banks Research & Analysis Insights & Views

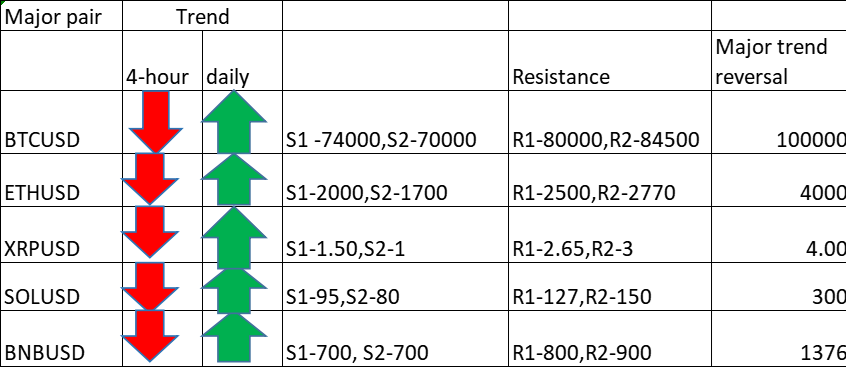

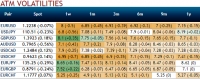

When all eyes are focussed on ECBs monetary policy today that may send hints of wrapping up of easing program and Switzerland at present, as a number of important heads of government are going to address the World Economic...

FxWirePro: Bid EUR/USD 1w/1m RRs to finance reverse collar spread for hedging ahead of ECB

Jan 25, 2018 06:48 am UTC| Research & Analysis Insights & Views Central Banks

The extrapolation of EURUSD levels of 1.24 indicates that the euro is seen as an attractive alternative to the US dollar by the market. But in this context let us refer to Thursdays ECB meeting. Even if the trade-weighted...

FxWirePro: Bid EUR/USD 1w/1m RRs to finance reverse collar spread for hedging ahead of ECB

Jan 25, 2018 06:48 am UTC| Research & Analysis Insights & Views Central Banks

The extrapolation of EURUSD levels of 1.24 indicates that the euro is seen as an attractive alternative to the US dollar by the market. But in this context let us refer to Thursdays ECB meeting. Even if the trade-weighted...

FxWirePro: The Day Ahead- 25th January 2018

Jan 25, 2018 05:44 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Data released so far: New Zealand: ANZ activity outlook index came at 15.6 percent, same as last...

Jan 24, 2018 13:01 pm UTC| Research & Analysis Insights & Views Central Banks

We at EconoTimes would audaciously proclaim that the CNHs recent strength is not just a function of extensive dollar weakness, as the currency is up a little over 1% since early December in nominal TWI terms. But in line...

FxWirePro: Swiss capital outflow leads to CHF depreciation – Buy EUR/CHF RV trades

Jan 24, 2018 11:04 am UTC| Research & Analysis Insights & Views Central Banks

The popular explanation for the drop in the franc in 2H17 emphasizes the currencys role as a negative yielding, safe-haven and its vulnerability to a continued rally in risk assets together with the rehabilitation of the...

US–India Trade Turbocharge: Stocks Poised to Ride the Export Wave

- Market Data