When pondering about the ECB’s monetary policy meeting today, a proverb strikes our mind: if the mountain won’t come to Mohammed. This seems to be exactly ECB President Mario Draghi’s approach.

Despite weeks and weeks of speculation in the market that the ECB might soon change its communication and hike the deposit rate at the end of the year, developments that caused the euro to take off and caused some ECB officials to make cautious comments, Draghi has not commented at all since the ECB meeting in December.

He is (quietly) firm as a rock. But tomorrow we will hear his comments. The market will hang on his lips to find out whether the interest rate speculation is justified and what the ECB head’s view on the euro appreciation over the past weeks is.

We have been urging caution for some time in EURUSD, as the market’s view is exaggerated, and we see scope for a correction in the euro.

EUR was the best performing major last year (+13% vs USD, +8% on the NEER) as a substantial upswing in the business cycle intersected with a downshift in the political risk cycle. EUR became economically and politically investable and the resultant inflow of long-term investment capital lifted the surplus on the region’s basic balance to its strongest ever level (€500bn). This inflow allowed the currency to close the valuation gap that had been established as a consequence of ECB policy and political risk (the EUR REER was 9% cheaper than its 20Y average ahead of the French election).

We expect EUR to continue its rehabilitation this year. The region’s economy is expected to outpace the US for the third consecutive year notwithstanding US tax cuts; the ECB will end QE as a prelude to tightening in 2019; EUR bond yields should rise by more than in other DM countries as they are more overvalued; balance of payments trends should remain strong and counter a further deterioration in front-end rate differentials; and political risks should be laid to rest for the next 1-1/2 years if Italy elects a mainstream government as seems probable based on the trend in the opinion polls (we attach only a 5% probability to a non-mainstream government.

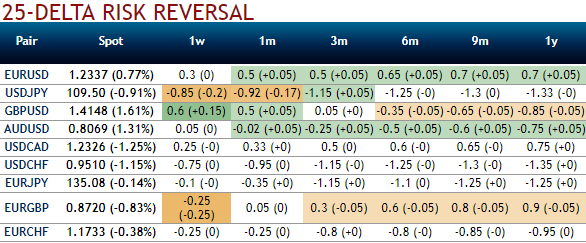

If you glance at OTC nutshell evidencing risk reversals, the above-stated euro strengthening is substantiated. Please be noted that the RRs of 1m-1y have been indicating the hedging sentiments of bullish risks, while 3m IV skews are also justifying the same stance.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data