When all eyes are focussed on ECB’s monetary policy today that may send hints of wrapping up of easing program and Switzerland at present, as a number of important heads of government are going to address the World Economic Forum in the snow-covered Davos. This is unlikely to lead to anything much for the FX market, as long as the US President, who will be speaking on Friday and who has already fuelled major concerns about increased tension in world trade with his decision to introduce import tariffs on solar panels and washing machines ahead of his appearance, does not make any surprise comments that cause the dollar to plummet. If Trump continues trumpeting protectionism the USD will remain under pressure due to concerns about a threatening trade war.

2017 started with negative news that had been holding the euro back, melting away like winter snow. Euphoria about US fiscal policy barely lasted into the New Year and the bond market sell-off that had started ahead of the Presidential election quickly ran out of steam. Gloom about the European economy met clear signs of recovery. Fears about the rise of populism and the possibility of Marine Le Pen winning the French presidential election were met with opinion polls that suggested this was very unlikely.

The result was that the euro rallied earlier and rose faster than expected, culminating in a final spike higher when the ECB President brought up the idea of further tapering of bond purchases. Now, with the ECB committed to buying EUR 30bn per month until September, 10y Bund yields are 25bp below their July levels and the positive economic outlook is largely priced in.

Wide divergence between the USD index and rate differentials, the surge in 10Y Treasury yields above 2.60, technically oversold price levels and momentum divergence set-ups in some USD-pairs, and the likelihood of profit taking on crowded Euro longs into next week’s ECB in anticipation of jawboning against recent currency strength are the commonly cited factors to support a tactical de-risking of short USD reflation trades.

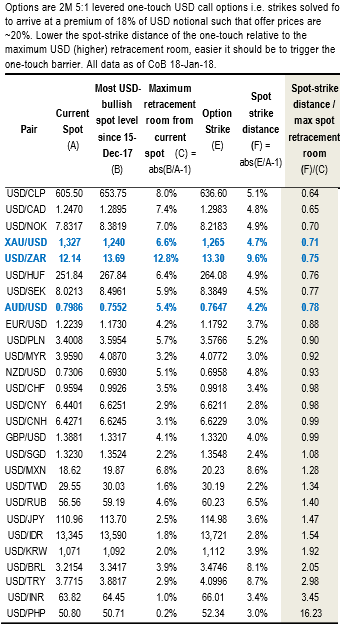

To this end, the above nutshell presents a simple relative value screen for short-dated one-touch (OT) USD call options that provide highly leveraged exposure to a broad USD rebound. The rich/cheap measure for directional (not delta-hedged) options used in the table is the ratio of spot-strike distance of 2M 5X geared (i.e. 20% price) OTs deflated by the maximum retracement headroom for the dollar since the start of the downtrend in mid-December; smaller the ratio, less the heavy lifting required of spot in order to trigger the maximum option payout.

Of the entries in the top half of the table, gold, AUD, and ZAR are the underlying crosses where the sharp rally in the spot over the past few weeks runs counter to JPM’s baseline macro view of medium-term weakness, hence most suited as overlays on short dollar portfolios. The judgment call is to avoid selling EUR and EUR-proxies such as NOK, HUF, and SEK on the view that the tailwinds of European growth upswing and ECB policy normalization will keep the uptrend in the currency intact and pullbacks shallow; also, the tail risk of a US government shutdown is likely to lift alternative reserve currencies like the Euro while hurting asset currencies like the antipodeans and the EMs, hence more reason to avoid buying dollars against the former.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings