The popular explanation for the drop in the franc in 2H’17 emphasizes the currency’s role as a negative yielding, safe-haven and its vulnerability to a continued rally in risk assets together with the rehabilitation of the Euro (many in the market view the franc as little more than the anti-euro).

Based on this framework, CHF continues to be vulnerable to a freeing up of the private capital outflows from Switzerland that have been in abeyance for a decade, both through a repatriation of safe-haven investments by non-residents and a reduction in the defensive home-market bias of Swiss investors.

While we are skeptical of the ‘wall of money’ argument for trend depreciation in the franc, we nevertheless recognize that there is a certain pent-up demand from a range of players to sell the currency.

These include a modest repatriation of foreign-held CHF deposits (the CHF 15bn outflow since the summer equates to 2% of GDP, with perhaps another CHF2530bn more to follow – refer above chart), renewed funding in the franc from short-term FX players if not longer-term, nonresident liability managers, and some selling by Swiss portfolio managers. Of these, an accelerated and potentially concentrated offshore diversification by Swiss investors poses the more significant risk to CHF.

We estimate pent-up capital outflows (excluding bonds as these are liable to be FX-hedged) at CHF 30-85bn. This averages out to 8.5% of GDP, so just a little less than the annual current account surplus for one year.

Sell 3m EURCHF 1.03 - 1.085 strangle against short EURCHF spot.

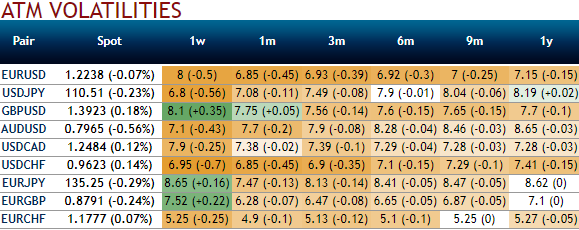

Please have a glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of all expiries have still been the least among G10 currency segment despite this week’s ECB’s monetary policy announcement which is significant. These lower volatile conditions are conducive for the option writers.

Let’s be noted that the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but bearish neutral risk reversals indicate that this pair to have been hedged for the downside risks as it indicates puts have been relatively costlier.

The persistent euro strength should nudge EURCHF higher but significantly. As a result, chances of calls being priced exorbitantly. 2w IV skews have been well balanced on both OTM call and put strikes.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

Naked Strangle Shorting:

Short 2m OTM put (2% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (2% strike referring upper cap) (we reiterate, comparatively short term for maturity is desired).

Overview: Slightly bearish in short-term but sideways in the medium term.

Timeframe: 3 months

When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Hence, writing such calls seems smart choice in tepid IVs on speculative or trading grounds.

Considering above OTC market reasoning, amid prevailing uptrend we think downside risks can also not to be disregarded in the long term, as result we reckon deploying shorts in such exorbitant call options.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell