Fundamental Evaluation Series: 2-year yield spread vs. GBP/USD

Aug 17, 2018 09:16 am UTC| Commentary Central Banks

The chart above shows, how the relationship between GBP/USD and 2-year yield divergence has unfolded since 2012. Brief history (2012-2016) The cozy relationship between the yield spread and the exchange rate, in this...

Aug 17, 2018 08:50 am UTC| Commentary Central Banks Economy

Bank Negara Malaysia (BNM) is expected to remain accommodative and growth supportive, with the Overnight Policy Rate (OPR) likely to be maintained at 3.25 percent throughout this year, according to the latest report from...

Fundamental Evaluation Series: USD/CHF vs. 2-year yield divergence

Aug 17, 2018 08:49 am UTC| Commentary Central Banks

During our evaluation period beginning 2012, the yield spread between the US 2-year bond and a Swiss equivalent has widened by almost 200 basis points but the exchange rate hasnt followed through as much as it should have...

Fundamental Evaluation Series: USDJPY vs. 2-year yield spread

Aug 17, 2018 08:33 am UTC| Commentary Central Banks

The above chart shows the relation between the 2-year bond spread (U.S. - Japan) and USD/JPY exchange rate. Brief background (2012-2016): This one pair has been at odds with yield divergence throughout early 2016 as...

Norges Bank keeps rates on hold, likely to hike rate in September

Aug 16, 2018 13:11 pm UTC| Commentary Central Banks

The Norwegian central bank met today and kept the interest rates on hold, as anticipated. The Norges Bank also affirmed the signals from the monetary policy report in June. The monetary policy meeting today was an interim...

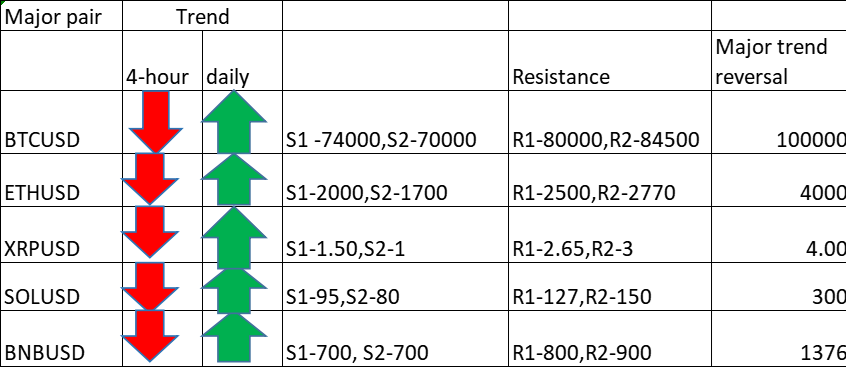

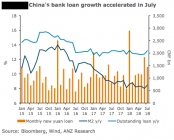

"It is unnecessary for the PBoC to employ broad-based monetary easing", says ANZ Research

Aug 16, 2018 09:08 am UTC| Commentary Economy Central Banks

According to the latest report from ANZ Research, it is unnecessary for the Peoples Bank of China (PBoC) to employ broad-based monetary easing. We may see marginal tightening in interbank market liquidity conditions and...

FxWirePro: Snippets of PBoC’s actions amid trade tensions and CNY hedging openings

Aug 14, 2018 14:03 pm UTC| Research & Analysis Insights & Views Central Banks

The major Asian currencies seem unchanged today, but significantly weaker in the medium-run, with CNY and KRW leading the way. USDCNY is again approaching 6.90, and the market expects that the PBoC could step into the...

Viksit Bharat 2026: Fiscal Muscle, Factory Revival, and the War on Speculation

- Market Data