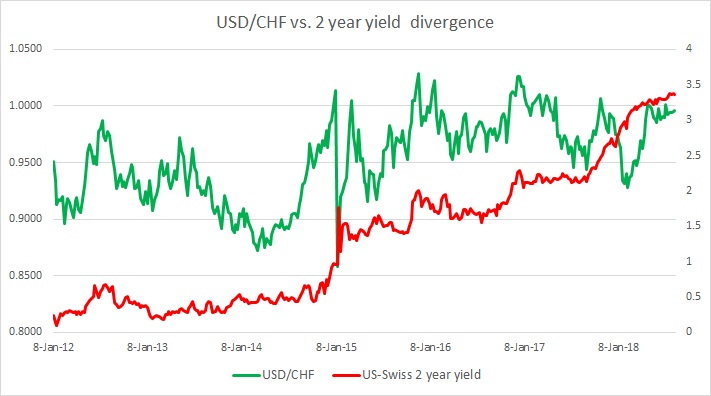

During our evaluation period beginning 2012, the yield spread between the US 2-year bond and a Swiss equivalent has widened by almost 200 basis points but the exchange rate hasn’t followed through as much as it should have been as it benefits from risk aversion inflows. Swiss franc remains the most overvalued currency against the dollar, in terms of yield divergence.

- Sometime Swiss franc’s correlation with the 2-year yield spread (US-Swiss 2 year) falls to negative, though, at times, it has shown relatively high positive correlation, as high as 90 percent. For example, Just before and after the Brexit referendum in the UK, the 20-day rolling correlation was averaging above 60. Hence, it is vital to keep a watch on the Swiss yields. The correlation is currently at +52 percent, suggesting less impact from the spread currently.

- Just after the Swiss floor shock in January 2015 when the Swiss National Bank (SNB) removed a floor in EUR/CHF at 1.20 this relation went to negative and stayed there till October with an occasional bounce to positive territory. It hasn’t gone much to the negative since, until recently.

- Unlike the euro or the pound, the Swiss franc is considered a safe haven currency; hence the yield relation sometimes gets overlooked. However, Swiss yields are a must watch as they are the lowest for any government bonds in the world and any shift in that will mark a major turnaround in trend.

Past Reviews:

- In our review in August, we noted that there have been minor changes in the spread compared to the July review which was trading at 213 basis points in favor of the dollar. The spread had narrowed by 4 basis points in favor of the Swiss franc since July review and the franc strengthened by 30 pips and trading at 0.965 per dollar. The 20-day correlation between the exchange rate and yield spread has recovered from negative to positive.

- In our September review, we noticed that the spread has widened in favor of the dollar by 12 basis points and the franc has weakened against the dollar by 40 pips but there still quite a gap between the exchange rate and the yield spread. The spread was then at 225 basis points and the USD/CHF was at 0.968. We also noted that the positive 20-day correlation has turned more to 23 percent from 2 percent in August.

- In our October review, we noted that the correlation strengthened further to 84 percent as of 31st October, while the spread has widened by another 20bps to 244 bps. The Swiss franc has weakened by almost 260 pips, thus reducing the divergence to some extent.

- In our last review in November, we witnessed that the yield spread has further widened by 17 bps in favor of the dollar to 261 bps and while franc has remained almost flat and was trading at 0.993 per dollar.

- In our December review, we noted that there has not been much of a movement. The spread has widened by 1 basis points to 262 bps and franc has strengthened from 0.993 to 0.986 per dollar. One important thing to note is that 20-day rolling correlation between the spread and exchange rate further from 79 percent to 75 percent.

- In our January review, we noted that the spread has widened further by 30 bps to 292 bps in favor of the dollar, but the franc has strengthened by more than 550 pips that have led to increasing divergence.

- In our February review, we noted that the spread has further widened by 19 bps to 311 bps and the franc has weakened by only 40 pips to 0.938 against the USD.

- In our March review, we noted that the spread widened further by 10 bps to 321 bps in favor of the dollar, which has strengthened somewhat against the franc, which was at 0.948 against the USD.

- In April review, we noted that the spread widened by 2 bps to 323 bps in favor of the dollar and franc weakened to 0.991 per USD reducing the divergence.

- In May, we saw that the spread widened marginally by 2 bps to 325 in favor of the dollar and franc weakened to 0.993 against the USD, thus reducing the divergence.

- The divergence continued to widen as spread reached 332 bps while franc is largely unchanged at 0.996 per USD.

- In July, the spread was at 333 bps as franc continued to test parity against the USD.

Analysis:

The correlation has sharply declined from m85 percent in July to 52 percent in August, as the current geopolitical situation in Turkey has turned the focus on risk aversion with regard to the Eurozone. The Franc gets benefited from haven flows whenever there is trouble in the Eurozone.

In August, the spread has further widened to 337 bps while the franc has continued to test the parity against the USD.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns