Bank Negara Malaysia (BNM) is expected to remain accommodative and growth supportive, with the Overnight Policy Rate (OPR) likely to be maintained at 3.25 percent throughout this year, according to the latest report from ANZ Research.

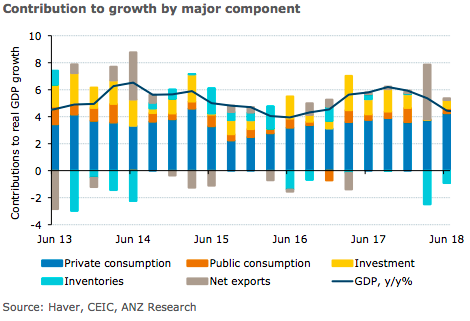

Malaysia’s gross domestic product (GDP) registered 4.5 percent y/y growth in Q2, down from 5.4 percent y/y in Q1. Private consumption, which has been the mainstay of growth, found further support from the withdrawal of GST on June 1.

Weak exports, coupled with buoyant imports, resulted in net exports subtracting 1.6ppts from growth in the quarter. The strains from global trade tensions have become apparent in the loss of momentum in exports in recent months.

Private consumption, which expanded 8 percent y/y compared with 6.9 y/y previously, has been the mainstay of growth and received a fillip with the withdrawal of the GST on June 1. Higher investment in “machinery & equipment” helped buoy overall investment activity at 2.2 percent y/y in Q2 (Q1: 0.1 percent). However, tepid construction activity resulted in investment in structures growing a meagre 2.1 percent y/y.

In the run up to the May elections, firms seem to have held back. Post-elections, as the new government placed key infrastructure projects under review, investments linked to such projects seem to have been delayed further. After the large draw-down in inventories in Q1, restocking demand is yet to pick up.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence