Mar 01, 2017 07:09 am UTC| Research & Analysis

Potential event risks: Kiwis Q4terms of tradeis expected to rise 4%, driven mainly by the 2016 surge in dairy prices, with subdued import prices adding to the mix. Theres little fresh news in the data, which is why the...

Feb 28, 2017 12:54 pm UTC| Research & Analysis

Glance over OTC: 1M lacklustre IVs uphold the significance of USDCHF long put butterfly spread: ATM implied volatilities are not rising considerably, still below 9% (to be precise 7.45% for 1m expiries and 8.55% for...

FxWirePro: GBP/JPY “Diagonal Option Strips” for vol convexity - 1m2w IVs to hedge major data events

Feb 28, 2017 06:17 am UTC| Research & Analysis Insights & Views

GDP, PMIs, and monetary policies in both continents (Data schedules): In theUK: Manufacturing PMIs on March 1st, Construction PMIs on March 2nd and Service PMIs on March 3rd, annual budget release on March 8th, BoEs...

Moody's: UAE regulatory changes are credit positive for insurers

Feb 28, 2017 02:08 am UTC| Research & Analysis

United Arab Emirates (UAE) insurers will likely see a medium-term improvement in their credit profiles as the sector adjusts to financial regulations introduced in February 2015 and overcomes initial compliance hurdles,...

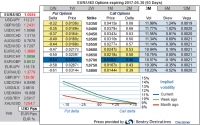

FxWirePro: Directional option trades to sync with EUR/USD OTC sensitivity tools and trend

Feb 27, 2017 09:51 am UTC| Research & Analysis Insights & Views

Please be noted that the risk reversal flashes across all tenors, although we see positive changes to the bearish risk sentiments across all tenors, hedging sentiments for bearish risks remain intact, whereas Euro seems to...

Feb 27, 2017 06:29 am UTC| Research & Analysis

The Swiss franc, Norwegian and Swedish Kroner have all suffered slightly this week from French political concerns, Euro has not been an exception. French opinion polls and Presidential politics generallyare now moving...

FxWirePro: Conditional benevolent election/European recovery via EUR call switches

Feb 24, 2017 11:57 am UTC| Research & Analysis

European election hedges have taken up considerable print space and investor mind space this year, the baseline view of a benign non-Le Penn outcome has invited relatively little option interest via EURUSD calls. Partly...

- Market Data