Potential event risks: Kiwis Q4 terms of trade is expected to rise 4%, driven mainly by the 2016 surge in dairy prices, with subdued import prices adding to the mix. There’s little fresh news in the data, which is why the market hardly ever reacts to it.

China: Feb Caixin and Markit PMI release with the index currently showing a positive trend in services whilst manufacturing has returned to its long-run trend.

NZ GDP Q4 print is scheduled to be released on March 15th.

BoJ monetary policy on March 15th.

RBNZ monetary policy scheduled on March 22nd that announces OCR.

OTC updates and hedging framework:

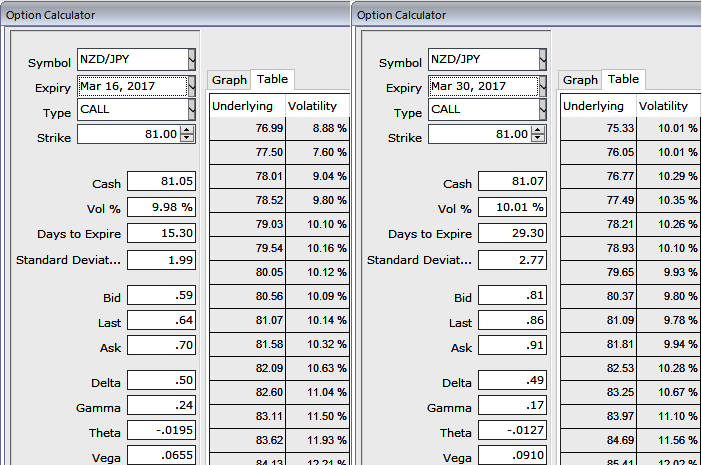

Please be noted that the 1m IVs are trading at around 10.01%, while 2w IVs are around 9.98%. The 1-month is to encompass all the above-mentioned data events. Despite the fact that the significant data events are lined up, you see dramatic movements in IVs which is good news for option writers.

In NZDJPY, if you're a sceptic on ongoing rallies to have a restricted upside potential (as stated in our technical write up, the stiff resistance at 83.762 levels) and expects abrupt declines then the below strategy is advisable. Visit our below web link for more reading on technicals of this pair:

Well, we expect NZD to fall through this year, reaching 74.800 against JPY by end of Q3 and even up to 69.313 at year-end. The support to growth from migration will fade, while the RBNZ -at the very least–are likely to hold rates steady as inflation normalizes, pushing real rates materially lower.

Ideally, the below option trading strategy is constructed for those who have exposures in spot FX of this underlying pair while, simultaneously, buying a protective put and shorting calls against that holding.

The strategy goes this way: while you're holding longs in spot FX of NZDJPY, go short in 2W (1.5%) OTM striking call and long in 1m (1%) OTM striking put. Since the short term, bullish sentiments are mounting we kept upside bracket little on the higher side.

Options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

On the flip side, when you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Use above mentioned IVs (2w1m) for both short and long legs respectively. This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying spot FX.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts