European election hedges have taken up considerable print space and investor mind space this year, the baseline view of a benign non-Le Penn outcome has invited relatively little option interest via EURUSD calls.

Partly because there isn't appreciable risk premium either in Euro spot to fade (not that too many were queuing up to do so in any event after the Brexit/Trump experience) and partly because markets await the passage of the event risk before turning their attention to the European recovery and/or ECB tapering story.

We understand the lack of urgency to mull EUR-positive outcomes at this stage, but highlight below an opportunity has opened up to cheaply position for postelection Euro strength via long EUR call/USD put vs. short EUR call/CHF put switches without expending enormous premium.

At the heart of the trade lie two observations. First, it is difficult for us to envision an environment where EURCHF spot rallies materially.

Directionally, we have long subscribed to a constructive Swiss Franc view due to Switzerland’s best-in-class current account surplus among developed nations and the absence of offsetting capital outflows that has necessitated sustained SNB intervention over the past few years.

It is noted that the intervention regime is signs of softening, with the objective morphing from the maintenance of a stable bilateral exchange rate versus EUR towards controlling the pace of franc appreciation.

This is in part due to some degree of inflation normalization, partly due to the steady creep higher in balance sheet and to some extent because of a less permissive international environment for continued intervention and/or reserve accumulation.

The risk bias on CHF around the modal 1.03 year-end target has also been upgraded from neutral to bullish to reflect political constraints around intervention, even without accounting for the tail risk of a Le Penn victory in the French elections.

EURCHF 3M vols have jumped recently as the day-weight-heavy second round of the French elections has entered the 3-month option expiry window.

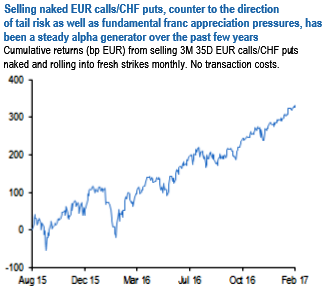

The jump has been most pronounced in ATM and OTM EUR put/CHF call strikes for obvious reasons, but even EUR calls/CHF puts have not been left unaffected by the repricing of the vol surface (Refer above chart) that has left the implied –realized vol gap at a hefty 3-4 vols.

This then is an opportunity to begin legging into short EUR calls/ CHF puts (naked, no delta hedge), either for standalone premium collection as a counter-weight to a long volatility portfolio, or as the funding leg of relative value structures.

Doing so is a “responsible” carry earning, passive reflection of a constructive franc view that dovetails with the technical spike in implied vols, and has the additional positive of a good track record as an alpha generator (refer above chart).

We reckon that any relief rally in EURCHF in the event of a benign passage of French elections should be limited to 1.0850-1.09 at the most, meaning 2% OTMS strikes should provide plenty of buffer for EUR call/CHF put sellers against a back-up in spot.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms