Please be noted that the risk reversal flashes across all tenors, although we see positive changes to the bearish risk sentiments across all tenors, hedging sentiments for bearish risks remain intact, whereas Euro seems to be losing traction in next 3 months tenor ahead of French elections.

On the flip side, USD’s robustness seems more attractive than euro on account of series of significant events such as the Trump’s stringent protectionism regulations, while the Fed’s chances of hiking in 2017 can certainly not be disregarded.

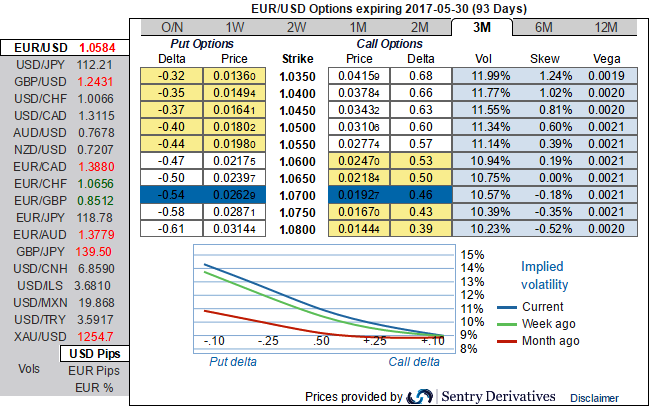

Moreover, all these factors are discounted in FX option market. You could make out this in mounting risk sentiments as you could see the positively skewed IVs in OTM put strikes.

Well, these positive skews in 3m implied volatilities suggest RKO calls on both hedging as well as speculative grounds, the EURUSD 2-3m skew has been well bid with Trump progresses in the beginning months to come. 1m IVs are tad below 8% (lower IVs good for option writers), while 3m IVs rising above 10.39% (higher IVs conducive for options holders).

We reckon the above fundamentals seem to be reasonably addressed by hedging participants, hence, contemplating above risk reversals and IV indications, we advocate below option strategy to mitigate risks on either way with cost effectiveness.

Hedging Framework:

Strategy: 3m 3-Way Diagonal Straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Let’s glance on sensitivity tool for 3m IV skews would signify the interests of OTM put strikes that would imply the ATM puts higher likelihood of expiring in-the-money, so writing overpriced OTM calls would be a smart move to reduce hedging cost.

The execution: Go long in EURUSD 3M at the money -0.49 delta put, and go long 3M at the money +0.51 delta call and simultaneously, Short 1m (1%) out of the money call.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms