Feb 15, 2017 11:40 am UTC| Central Banks Research & Analysis Insights & Views

We encourage longs in USDRUB for long term investing amid short-term slumps, the broader setback to the dollar combined with upward pressure on oil prices to new highs this week have conspired to pull USDRUB lower in short...

Feb 15, 2017 10:13 am UTC| Research & Analysis

This weeks price action on oil benchmarks traversed almost the entire range within which prices have been held since early December, despite a near record build in US crude inventories appearing in the weekly EIA...

FxWirePro: Intricacies of bullish and bearish scenarios of Yen and hedging perspectives

Feb 15, 2017 05:44 am UTC| Research & Analysis

Bearish Yen: USDJPY to 125 if 1) strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, 2) Japanese governments fiscal policy becomes more expansionary and the BoJ finances...

Moody's: Chinese local government incentives hinder central government reform agenda

Feb 15, 2017 03:34 am UTC| Research & Analysis

Moodys Investors Service says that misaligned incentives between Chinas (Aa3 negative) central and regional and local governments (RLGs) are an obstacle to economic reform and rebalancing, a credit negative. In...

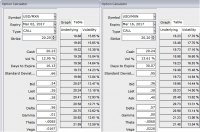

FxWirePro: Diagonal debit credit spreads to hedge USD/MXN as Mexican peso going with EMFX trend

Feb 14, 2017 12:26 pm UTC| Research & Analysis Commentary

The sentiment towards EM currencies remains quite positive. Even the long-suffering Mexican peso is able to benefit from this development. Some commentators have already declared that the peso has seen the worst. Ofcourse,...

FxWirePro: Stay short AUD/JPY through a one-touch calendar spread

Feb 14, 2017 12:16 pm UTC| Research & Analysis

We designed a bearish AUDJPY view through a calendar spread of one-touches (short a 3m one-touch put, long a 6m) to arrest the good-bad dichotomy in Trumps policy platform (an initial focus on pro-growth fiscal policy...

FxWirePro: Tactical upholding longs in USD/TWD via NDF derivatives

Feb 14, 2017 11:29 am UTC| Research & Analysis Insights & Views

We uphold longs in USDTWD 1m NDF at 30.777 with a target at 31.8 and a stop at 30.2. The 1m tenor is chosen because it has the highest annualized carry (positive carry of 32bp over a 1m horizon). The time horizon of the...

- Market Data