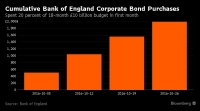

Chart of the Day: Burning fast

Oct 27, 2016 16:40 pm UTC| Commentary Central Banks

This chart from Bloomberg markets shows that the Bank of England (BoE) has used almost 2 billion pounds in the very first month of its corporate asset purchase program. Its an 18-month program with 10 billion pounds...

Oct 27, 2016 12:10 pm UTC| Central Banks Commentary

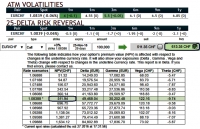

OTC updates: The ATM implied volatilities are not rising considerably, still below 7.5% (to be precise 6.5% for 1W expiries and 7.25% for 1M expiries). Well, if you have short positions in option and IVs are shrinking...

Upbeat UK Q3 GDP data lowers chances of Bank of England's easing next week

Oct 27, 2016 11:32 am UTC| Insights & Views Economy Central Banks

Data released by the Office for National Statistics on Thursday showed that UK Q3 GDP grew by 0.5 percent, beating forecasts for 0.3 percent growth. Growth was, however, slower than the 0.7 percent recorded in the second...

Riksbank keeps policy rate on hold, likely to expand bond purchase program in H1 2017

Oct 27, 2016 09:06 am UTC| Commentary Central Banks

The Swedish central bank, Riksbank, kept its policy rate on hold at -0.5 percent during its meeting today, as was widely anticipated. However, the central banks message today seems dovish and is expected to ease further,...

FxWirePro: A glimpse on Swiss franc – Uphold USD/CHF put ladders on 1m tepid vols

Oct 27, 2016 07:41 am UTC| Central Banks Commentary

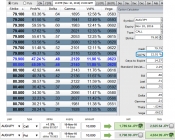

Stay short in USDCHF; trade is very close to stop-out level. This trade was initially recommended in September post-BoJs September policy framework change on the expectation that the BoJ shift would bring attention to...

Oct 27, 2016 06:57 am UTC| Central Banks Commentary

The RBAs Q3 print sat awkwardly for the market, with the first blush of headline inflation leaving investors pondering if the low has been set. However, underlying inflation was certainly soft and does not eliminate the...

Oct 26, 2016 12:50 pm UTC| Central Banks Commentary

Polands Central Statistical Office (GUS) gave guidance that we should expect Q3 GDP to have increased by just under 3.1%, about similar to Q2. But the forecasts for Q3 GDP were marginally lowered after IP and retail...

- Market Data