Oct 28, 2016 10:14 am UTC| Central Banks Commentary

This weeks Focus updates our estimates of external debt in Emerging Asia, broken into foreign bank loans to the region and foreign currency-denominated debt securities issued by Asias banks, corporates, and...

Oct 28, 2016 09:54 am UTC| Central Banks Commentary

The discounted gloomy UK outlook both prevents a new bold depreciation and a much stronger currency. The technical picture suggests a new turbulence and bearish pressures. GBPNZD made the fresh post-float lows following...

Oct 28, 2016 09:15 am UTC| Central Banks Research & Analysis Commentary

New Zealand posted a NZD 1436 million trade deficit in September of 2016, compared to a NZD 1140 million shortfall a year earlier and beyond market projections of NZD 1125 million gap. Exports dropped by 5.7 pct, led by...

Oct 28, 2016 08:51 am UTC| Central Banks Commentary

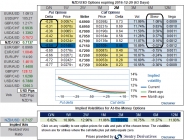

Before we begin with this write-up, please be informed that 2m NZDUSD ATM puts are flashing deltas around -0.54. NZDUSD has been tumbling considerably offlate, dropped from the highs of 0.7485 to the current 0.7134...

Oct 28, 2016 07:17 am UTC| Central Banks Commentary

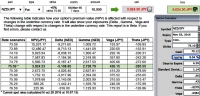

On economic data radar over next fortnight: BoJ economic outlook report, monetary policy decision and policy rates on Oct 31st. GDT price index, Kiwis unemployment rates and inflation reports are scheduled to be...

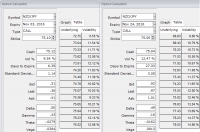

FxWirePro: What drives you writing overstated exorbitant NZD/JPY options?

Oct 28, 2016 06:00 am UTC| Central Banks Commentary

For an instance, 1w ATM puts and calls of this pair are trading 28% and 30% respectively more than NPV. While the ATM implied volatilities of the same tenor are at just shy above 9.5%. The standard deviation of this put...

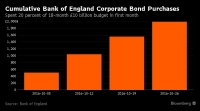

Chart of the Day: Burning fast

Oct 27, 2016 16:40 pm UTC| Commentary Central Banks

This chart from Bloomberg markets shows that the Bank of England (BoE) has used almost 2 billion pounds in the very first month of its corporate asset purchase program. Its an 18-month program with 10 billion pounds...

- Market Data