Stay short in USDCHF; trade is very close to stop-out level.

This trade was initially recommended in September post-BoJ’s September policy framework change on the expectation that the BoJ shift would bring attention to central banks which are near limits and result in the strengthening of those currencies.

CHF was a prime candidate with SNB’s balance sheet size which has continued to grow by as much as 20%pts of GDP since the floor collapsed in 2015. Moreover, the expectation was that the dollar would trade at a discount relative to other reserve currencies like EUR, JPY and CHF.

Indeed, even the typical pattern of a EURUSD bounce post-ECB appears to be not realizing. CHF has been somewhat insulated from this move but with EURCHF approaching it’s 3-month low of 1.08, USDCHF will likely be more vulnerable to a further decline in EURUSD (this year, SNB FX intervention activity has tended to increase with EURCHF approaching 1.08).

Our short USDCHF is a whisker away from our stop level of 0.9970, which we keep unchanged given this risk, even though we continue to have a bullish view on CHF medium-term.

Short USDCHF has come under pressure given the relentless and idiosyncratic decline in EURUSD. While we are bullish CHF long-term, we leave our stop of 0.9970 on this trade unchanged and are close to being stopped out.

Maintain shorts in USDCHF at spot reference 0.9934. Marked at -1.73%. Stop at 1.0000 levels.

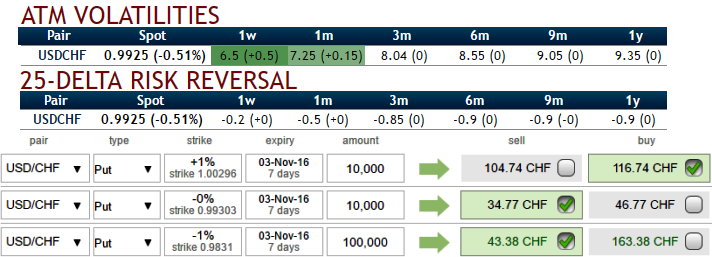

1M lackluster IVs uphold the significance of USD/CHF long put ladders:

ATM implied volatilities are not rising considerably, still below 7.5% (to be precise 6.5% for 1W expiries and 7.25% for 1M expiries). Well, if you have short positions in option and IVs are shrinking away, bingo..!! It's a conducive environment for option writers.

While, risk reversals have also been in sync with IVs and spot FX movements as stated above in technical lines, these numbers also have been bearish-neutral for next 1 month or so.

Hence, we recommend long put ladder or bear put ladder strategy, that is a limited returns and unlimited risk strategy in options trading that is employed as we reckon that the IVs are the least and the underlying spot would experience little volatility in the near term.

To setup this strategy, the options trader initiates the following positions (as shown in the diagram, these positions resemble put ladders):

Go long in an in-the-money put, sells an at-the-money put and sells another lower strike out-of-the-money put of the same underlying security and expiration date.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022