FOMC monetary policy November 2016: Assessing future bias

Nov 03, 2016 08:40 am UTC| Commentary Central Banks

Yesterday, FOMC policymakers preferred to keep policy steady and not to go for a hike. This was somewhat expected given the division among policymakers and the meeting concluding just days before the US election. Lets...

Nov 03, 2016 07:42 am UTC| Central Banks Research & Analysis

Today, thefocus would be on the Bank of England meeting and deemed as Super Thursday, where we get to see the policy announcements, minutes, an updated Inflation Report and Mark Carney hosts a press conference. The...

Nov 03, 2016 07:14 am UTC| Central Banks Research & Analysis

On the eve of Bank of Englands monetary policy today, lets begin by recalling as to how the UK central bank confused the markets in previous MPS. There was the widespread surprise when the MPC chose to leave rates...

BoE Preview: MPC to hold fire and adopt a less dovish tenor

Nov 03, 2016 06:53 am UTC| Commentary Central Banks Economy Insights & Views

The Bank of England will conclude its November monetary policy meeting on Thursday by 12:00 GMT. We expect the meeting to end in the decisions to maintain the official Bank Rate at 0.25 percent and keep the programme of...

FOMC Review: Fed leaves policy rates unchanged, flags December rate hike

Nov 03, 2016 04:54 am UTC| Commentary Economy Central Banks

The Federal Reserve left policy rates on hold at the Federal Open Market Committee (FOMC) meeting that concluded Wednesday, flagging possibilities of a December rate hike. The central bank will continue to monitor the...

FxWirePro: The Day Ahead- 3rd November, 2016

Nov 03, 2016 04:45 am UTC| Commentary Economy Central Banks

Lots of data and events today and some with high risks associated. Data released so far: Australia: Trade balance for September came at -1.23 billion. Imports declined by 1 percent, while exports are up by 2...

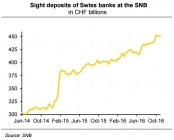

Rise in sight deposits exposes SNB's strategy, long-term EUR/CHF downside risk remains

Nov 02, 2016 12:10 pm UTC| Insights & Views Central Banks

The Swiss National Bank (SNB) had previously capped the nations currency at 1.20 per euro before abandoning the defense in January 2015. Abandoning the currency cap didnt stop the SNB which has sought to weaken the franc...

- Market Data