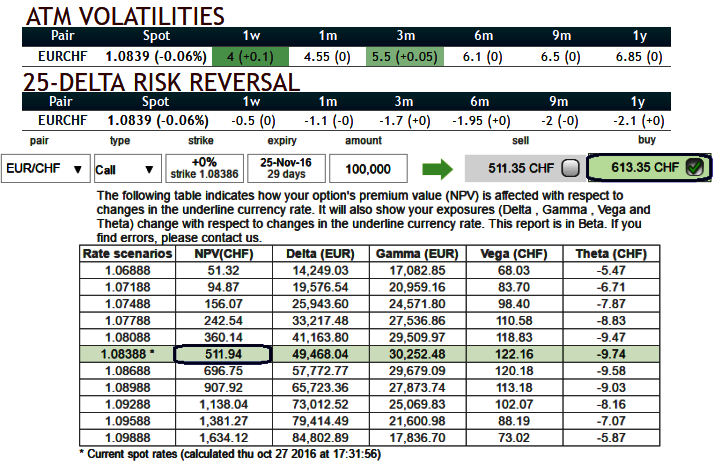

OTC updates: The ATM implied volatilities are not rising considerably, still below 7.5% (to be precise 6.5% for 1W expiries and 7.25% for 1M expiries). Well, if you have short positions in option and IVs are shrinking away, bingo..!! It's a conducive environment for option writers.

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have been the least among G10 currency segment.

While, the 25-delta risk of reversal of EURCHF has also not been indicating any dramatic shoot up nor any slumps, but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

Central Banks: CHF was a prime candidate with SNB’s balance sheet size which has continued to grow by as much as 20%pts of GDP since the floor collapsed in 2015.

Short term risk sentiment will continue to pose appreciation pressures. SNB likely to remain active - Despite the real economy and inflation still under pressure from the appreciation of the CHF, the currency remains heavily overvalued. Fundamentals still points to a weaker CHF.

While expecting the ECB to continue APP, we do not expect the SNB to have to lower interest rates - Foreign appetite for CHF assets has abated. The negative interest rates are likely to push Swiss investors to invest more abroad, once global market sentiment improves.

Hedging Strategy:

Considering the pair’s short term bearish risks and long lasting non-directional trend and the corresponding OTC arrangements, writing a mid-month (0.5%) out of the money calls and simultaneously, long in at the money delta puts of the similar expiries would optimally hedge the FX downside risks.

Most importantly, please be noted that the 1m ATM calls are priced 20% more than that of NPV, whereas, IVs these tenors are just shy above 4.5%, hence, we could see the disparity between option pricing and IVs.

To hedge long term bearish risks we’ve chosen 2m ATM longs in puts that would save your spot FX payable exposure if any would be protected on account of potential dips in this pair. The initial credit received from short leg would reduce the cost of hedging as we would not foresee any dramatic spikes that could burden writers of the calls to obligate the options in medium terms.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady