Swiss National Bank to remain active on FX market to prevent CHF from appreciating against EUR

Nov 22, 2016 08:53 am UTC| Commentary Economy Central Banks

In early 2015, the Swiss economy coped up quite well with the end of the EUR/CHF minimum exchange rate. In the second quarter of this year, the Swiss economy registered an impressive growth of 0.6 percent in sequential...

Nov 22, 2016 07:27 am UTC| Central Banks Commentary

Sub-1Y USDJPY vol to underperform, but long-end (3Y-5Y) in play on higher rates: Yen vols were a marked outperformer this year as USDJPY shed nearly 17% peak-to-trough, but this is likely to change going forward under...

Nov 22, 2016 06:46 am UTC| Central Banks Research & Analysis

The market is currently seeing the likelihood of three Fed rate hikes until late 2017 as standing at 50% the highest level since the FOMC meeting in March. At the time the market was still convinced that there would be a...

FxWirePro: The Day Ahead- 22nd November, 2016

Nov 22, 2016 04:02 am UTC| Commentary Economy Central Banks

Not many economic dockets scheduled for today and all with low to medium risks associated. Upcoming: Switzerland: Trade balance data for October will be reported at 7:00 GMT. United Kingdom: Public sector...

December US Fed Interest Rate Hike – First of Many?

Nov 21, 2016 18:51 pm UTC| Commentary Central Banks

It has been a busy month for the United States and as the furor over the election dies down its impact on the global financial market is still ongoing. With so much still up in the air and investors wary of how the...

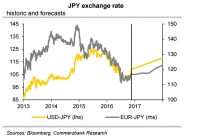

Rising US dollar reduces pressure on Bank of Japan to act

Nov 21, 2016 11:52 am UTC| Insights & Views Economy Central Banks

Bank of Japan at the start of the year reacted by surprisingly lowering its interest rates on part of the bank reserves into negative territory. In its September meeting, the central bank changed its monetary policy...

National Bank of Hungary likely to stay on hold, following improvement in inflation figures

Nov 21, 2016 10:35 am UTC| Central Banks

The National Bank of Hungary is expected to remain on hold, following considerable improvement in inflation numbers The central bank can be satisfied that money market interest rates remain low on the one hand, and...

- Market Data