Bank of Japan at the start of the year reacted by surprisingly lowering its interest rates on part of the bank reserves into negative territory. In its September meeting, the central bank changed its monetary policy strategy. According to the new strategy, the BoJ switched to yield-curve control, rather than its already negative benchmark interest rate.

The BOJ said it would buy 10-year Japanese government bonds (JGBs) to keep the yield around zero percent while keeping a lid on short-term rates. While on the other side, it maintained the pledge to expand the monetary base until inflation exceeds the 2 percent target. Trump's win has sparked a global sell-off in bonds, which is testing the BOJ's ability to contain gains in yields under its new policy framework.

Trump's victory stoked expectations of huge fiscal stimulus, leading to generally higher growth and inflation. That sparked a sell-off in US Treasuries, dragging down prices and lifting yields for Japanese Government Bonds. This presents an early test of the BOJ's strategy overhaul. On Thursday last week, the central bank offered to buy shorter-dated bonds in unlimited amounts showing how the revamped framework aims to shield Japan from rising global yields.

Bank of Japan board member Takako Masai in a speech earlier on Monday expressed concern about sudden changes in financial markets given the backdrop of rising uncertainty about the global economy.

Inflation in Japan remains low and has even been negative again since March. In September even the core rate excluding energy and food eased back to zero again. BoJ once again had to postpone the time when it projects the inflation target to be reached; it now expects that inflation will reach the target of 2 percent during the fiscal year of 2018.

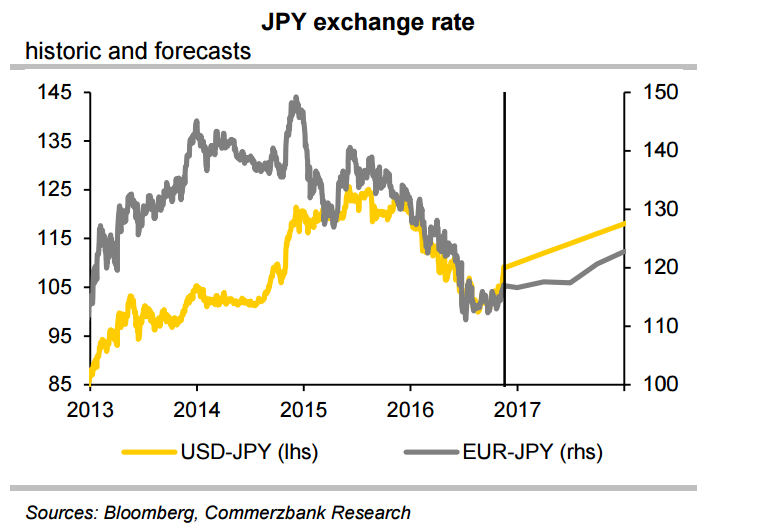

That said, JPY appreciation trend has paused. JPY exchange rates have stabilized. Most recently JPY was even able to depreciate notably mainly due to a stronger USD. Since the election of Donald Trump as US President-elect, the FX market is banking on a notably tighter US monetary policy so that USD is likely to appreciate further against JPY. Falling JPY exchange rate is likely to exert a positive influence on inflation expectations and reduce pressure on BoJ to act.

USD/JPY was trading at 110.66 at around 1145 GMT. At the said time FxWirePro's Hourly USD Spot Index was at 67.191 (Neutral) and Hourly JPY Spot Index was at -51.9838 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target