Sub-1Y USDJPY vol to underperform, but long-end (3Y-5Y) in play on higher rates:

Yen vols were a marked outperformer this year as USDJPY shed nearly 17% peak-to-trough, but this is likely to change going forward under the aegis of the BoJ’s yield curve control framework that has worked to anchor JGB yields better than we expected, and as the pair encounters offsetting forces of higher US-Japan rate differentials and greater risk-aversion from EM weakness.

Selling gamma or USDJPY ranges may not be the natural expression of the view however given the potential for US rates volatility to trigger abrupt changes in JPY FX/rates betas, for instance, due to yen strength from a spillover of bond market stress onto hitherto-calm ultra-long-end JGBs.

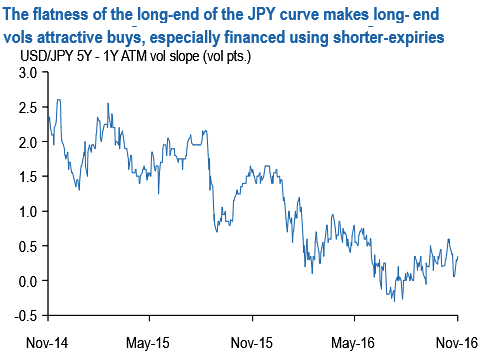

Hence 6M-1Y expiries a tad removed from high-frequency spot noise will likely be a better short vol target than very front-end expiries. In addition, the risk of disorderly rates and the almost-forgotten BoJ tapering story latter also make rates-sensitive 3Y-5Y vols decent buys especially given the flatness of the long-end of the yen vol curve (Refer above chart).

As a general rule, 11.0 has served as strong support for USDJPY 5Y vols this year which are best bought at or below that level, and carry efficiently so by financing the purchase by selling 1Y2Y vol in the calendar spread structures.

For a low-touch alternative to vanilla option calendars, consider 2Y2Y or 3Y2Y forward vol agreements (FVAs) that sacrifice direct exposure to forward point / rates gamma for ease of management.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook