Nov 25, 2016 01:16 am UTC| Central Banks Research & Analysis

The most recent South African economic data was not exactly constructive: the unemployment rate rose to over 27% in Q3 and the inflation rate also rose to 6.4% in October. That means it has eased only slightly against its...

ECB's policy unlikely to affect CNB’s decision to exit EUR/CZK floor - Gov Jiri Rusnok

Nov 24, 2016 15:35 pm UTC| Commentary Central Banks

Czech National Bank governor Jiri Rusnok in an unexpected turn of events announced yesterday that the European Central Banks (ECB) eventual extension of bond-buying programme may not affect Czech National Banks (CNB)...

Swiss National Bank stands ready to act if necessary - SNB's Jordan

Nov 24, 2016 14:38 pm UTC| Commentary Central Banks

Swiss National Bank (SNB) Chairman Thomas Jordan declined to comment if SNB was active in FX market after US election but reiterated the central banks commitment to keep upside in CHF under check. Data released on...

Nov 24, 2016 13:11 pm UTC| Central Banks Research & Analysis

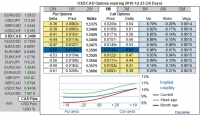

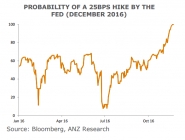

The market is currently seeing the likelihood of three Fed rate hikes until late 2017 as standing at 50% the highest level since the FOMC meeting in March. At the time the market was still convinced that there would be a...

Central Bank of Turkey hikes repo rate for first time since early 2014

Nov 24, 2016 12:25 pm UTC| Commentary Central Banks

The Turkish central bank, Central Bank of the Republic of Turkey (CBRT) hiked its repo rate during its monetary policy meeting today for the first time since early 2014. The CBRT raised the interest rate by 50 basis points...

FOMC members consider December hike "important to Fed credibility"

Nov 24, 2016 12:25 pm UTC| Insights & Views Economy Central Banks

Minutes of the November Federal Open Market Committees (FOMC) meeting released on Wednesday were largely unexciting from a near-term policy perspective. After the recent Congressional testimony of Chair Yellen and...

Political uncertainty amid risks of rating downgrade continues to pressurize ZAR

Nov 24, 2016 11:52 am UTC| Commentary Economy Central Banks

The South African rand is witnessing continuous pressure, following ongoing political uncertainty in the country, coupled with risks of a rating downgrade. Further, the central bank is expected to leave its key rate...

- Market Data