Apr 13, 2018 13:26 pm UTC| Research & Analysis Central Banks Insights & Views

Among the most susceptible economies owing to trade tensions, South Korea has slowed its pace of rate hikes. Yes, Bank of Korea (BOK) maintained its rate policy unchanged at 1.50% this morning, which was widely...

FxWirePro: The Day Ahead- 13th April 2018

Apr 13, 2018 04:31 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, and all with low to medium volatility risks associated. Data released so far: China: March trade balance came at -$4.98 billion, with exports rising by 7.4...

FxWirePro: The Day Ahead- 12th April 2018

Apr 12, 2018 05:10 am UTC| Commentary Central Banks

Not many economic data and events scheduled for today, and all with low to medium volatility risks associated. Data released so far: Australia: Consumer inflation expectation declined to 3.6 percent in April...

Apr 11, 2018 06:56 am UTC| Research & Analysis Central Banks Insights & Views

The Aussie remains pricey compared to short-term fair value estimates. Yield differentials along the curve continue to move steadily in the US dollars favor, but the more notable move in recent weeks is the slide in...

FxWirePro: Spot on sensitive yields of US treasury and pick up functional instruments

Apr 10, 2018 09:29 am UTC| Research & Analysis Central Banks

Everywhere across the globe trade tariff related talks are heated debate. The news that China was looking into using a devaluation of the renminbi as a tool in case the trade conflict with the US was going to escalate,...

Apr 10, 2018 06:12 am UTC| Commentary Central Banks Economy

The Bank of Korea (BoK) is expected to leave its policy rate unchanged at 1.50 percent on Thursday morning, largely due to the nations benign inflation outlook, hovering U.S.-China trade disputes and the Feds further...

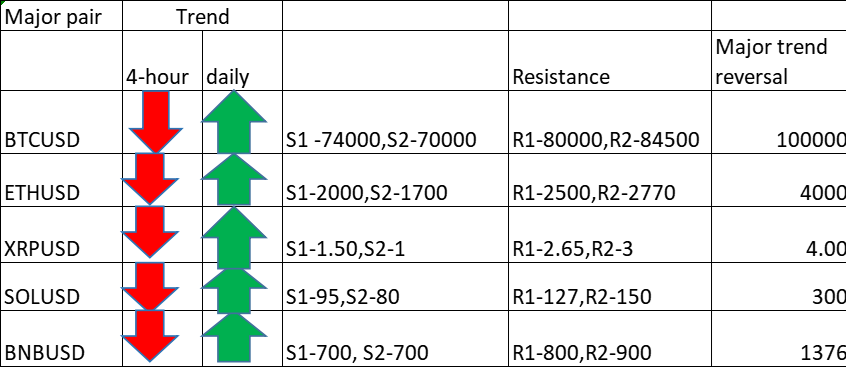

FxWirePro: Spotlight on G10 FX universe amid trade tensions and FOMC minutes

Apr 09, 2018 08:04 am UTC| Research & Analysis Central Banks

Amid the overhang from global trade tensions, the dollar fell against the EUR, GBP, and CHF as rhetoric out of China (from the Commerce Ministry on Friday) grew increasingly strident. Note however that the cyclical closed...

- Market Data