The Aussie remains pricey compared to short-term fair value estimates. Yield differentials along the curve continue to move steadily in the US dollar’s favor, but the more notable move in recent weeks is the slide in commodity prices, including a 20% drop in spot iron ore in March. Optimism over global growth is being challenged by US-driven trade tensions which pose downside risks to global trade volumes and AUD

RBA Governor Lowe speaks on ‘Regional Variation in a National Economy’, RBA outlook likely to be on hold throughout 2018 and is anchoring short-maturity interest rates and should keep 3yr swap rates in a 1.80% to 2.30% range, as long as core inflation remains below 2%.

Elsewhere, BoJ’s governor, Kuroda’s speech is also scheduled today, expectations for more hawkish than the expected stance of the Japanese central bank if inflation expectations heighten. He also said in a news conference that the central bank would eventually need to consider how to normalize its ultra-easy policy, suggesting the priority of his next tenure could be to dial back a massive stimulus he deployed five years ago.

The above-stated factors can pose such a risk to FX markets that is not under any foreign traders’ control. This could only be kept on the check by deploying smart hedging strategies.

While our technical analysis suggests that overall AUDJPY major trend that was in the consolidation phase from the lows of 72.437 since June 2016 retraced almost more than 50% Fibonacci level. But for now, by bears repeating the history near stiff resistance levels of 90.254, weakness is mounting. Despite mild rallies that seem to be edgy below 38.2% Fibonacci levels, the major downtrend has resumed. As a result, the current price has gone below EMAs on monthly terms with the bearish crossover that indicate further downside risks. (See our technical section for more reading). These anticipated risks can be mitigated.

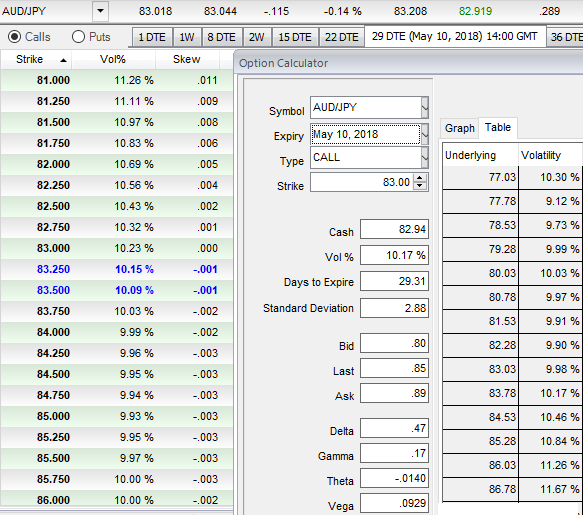

AUDJPY vols of 1m tenors are also at the decent side (10.17%) which is conducive for option holders, while skews have positively stretched on OTM put with attractive gammas.

Contemplating these aspects, on hedging grounds, risk-averse traders, capitalizing on deceptive rallies of the underlying spot FX, we advocate snapping rallies and buying a 1M 81.540 AUDJPY one-touch put.

Alternatively, those who wish to reduce the cost of hedging; we advocate buying 1M shorting 1w AUDJPY put spreads at 82.114/83.730 strikes in 1:0.753 notionals.

The above nutshells indicate how the option's premium value (NPV) is affected with respect to changes in the underline currency rate. It will also show the exposures (Delta, Gamma, Vega and Theta) change with respect to changes in the underline currency rate. This report is in Beta.

The Options Greek is the rate of change of the Delta with respect to the movement of the rate in the underlying market.

In the sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 6 levels (which is neutral), while hourly JPY spot index was at shy above -95 (bearish) while articulating (at 06:55 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise