FxWirePro: What to watch in FOMC meet ahead?

Aug 01, 2018 10:34 am UTC| Commentary Central Banks

Today, the U.S. Federal Reserve will announce its monetary policy decision at 18:00 GMT. While the majority of the policymakers do support faster rate hikes, some policymakers are expressing doubts over the narrowing of...

Aug 01, 2018 08:37 am UTC| Commentary Economy Central Banks

Labour market conditions were generally firmer in the June quarter. Jobs growth was robust, though the unemployment rate ticked up slightly. With the economy moving closer to full capacity, the first signs of a stirring in...

Aug 01, 2018 08:12 am UTC| Research & Analysis Central Banks

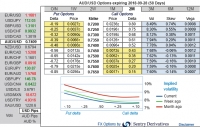

The Aussie dollar underperformed in the weeks of broad US dollar strength following the FOMC and ECB mid-June meetings but so far in July, it has been near the middle of the G10 pack. On the flips side, the USD had been...

Fed likely to maintain target range at 1.75-2.00 pct at today’s meeting, says Danske Bank

Aug 01, 2018 07:27 am UTC| Commentary Economy Central Banks

The Federal Reserve is expected to maintain the target range at 1.75-2.00 percent at its upcoming monetary policy meeting, scheduled for later in the day, according to the latest research report from Danske Bank. No new...

FxWirePro: Series of headwinds for Turkish lira, NDF auction in line with CBRT

Jul 31, 2018 14:01 pm UTC| Research & Analysis Central Banks

The CBRT let down analysts at its recent monetary policy meeting keeping the policy rate on hold at 17.75%. The analyst consensus, as well as market pricing, was for a 100 bps hike. The Turkish central bank elucidated...

FxWirePro: BoJ’s shift in monetary policy stance - A run through on USD/JPY put spread structure

Jul 31, 2018 13:11 pm UTC| Research & Analysis Central Banks

Today, the Bank of Japan (BoJ) confirmed last weeks rumours and tweaked by announcing a shift to the range of assets it would buy as the form of its yield curve control strategy and introduces extensive forward guidance...

Jul 31, 2018 12:14 pm UTC| Research & Analysis Central Banks

USDCAD caught between several factors, such as the ongoing storm-cloud of US trade policy escalation, NAFTA, crude prices and an otherwise constructive cyclical outlook that is still warranting gradual rate hikes. Price...

Viksit Bharat 2026: Fiscal Muscle, Factory Revival, and the War on Speculation

- Market Data