FxWirePro: EUR/NZD bullish/bearish scenarios and derivatives trades perspectives ahead of ECB

Jul 25, 2019 07:35 am UTC| Research & Analysis Central Banks

Bearish EURNZD Scenarios: 1) ECB goes all-in with rates cuts, tiering and QE. 2) Trump proceeds with tariffs on Euro car imports. 3) A no-deal Brexit. 4) Kiwis fiscal easing is accelerated; 5) Housing begins...

FxWirePro: The Day Ahead-25th July 2019

Jul 25, 2019 05:00 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Upcoming: Spain: Q2 unemployment survey report will be released at 7:00 GMT. Germany: IFO business climate...

FxWirePro: Trades Recommendations For Commodity-Driven Currencies

Jul 24, 2019 10:24 am UTC| Research & Analysis Central Banks

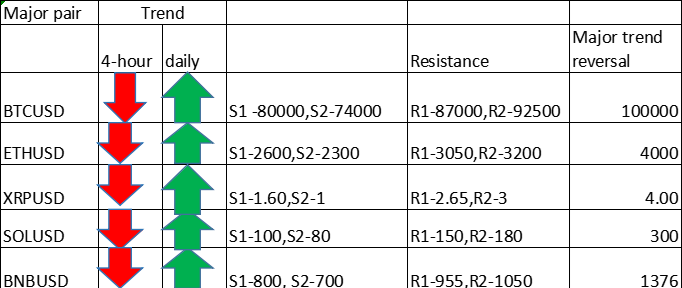

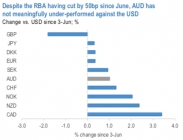

RBA being well ahead of the global easing cycle, AUD has not suffered meaningful under-performance (refer 1stchart). In part, this has been due to the relatively more dovish rhetoric from central bank officials in the US...

FxWirePro: The Day Ahead-24th July 2019

Jul 24, 2019 06:21 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Data released so far: Japan: Nikkei manufacturing PMI low at 49.6 in July, signaling continued weakness in the...

FxWirePro: Glimpse at Bearish Antipodeans - Hold short AUD/CHF and NZD/JPY put spread

Jul 23, 2019 12:35 pm UTC| Research & Analysis Central Banks

The RBA may have eased proactively in June which may buy the Bank some time before easing again, but this will not necessarily preclude AUD from fading further in coming weeks. In particular, the ongoing deterioration...

FxWirePro: Can ECB deliver stimulus? Bid 3m EUR/AUD skews and deploy options straps

Jul 23, 2019 09:08 am UTC| Research & Analysis Central Banks

Fearful that investors might be losing confidence in the ECBs ability to bring inflation back up to its goal, policymakers have hinted that they are prepared to increase stimulus measures. The first port of call is...

MAS likely to slightly reduce slope of S$NEER policy band amid economic slowdown, says Scotiabank

Jul 23, 2019 08:47 am UTC| Commentary Central Banks Economy

The Monetary Authority of Singapore (MAS) is expected to slightly reduce the slope (i.e. the annual rate of appreciation) of its S$NEER policy band to 0.5 percent from current 1.0 percent, when holing its second...

- Market Data