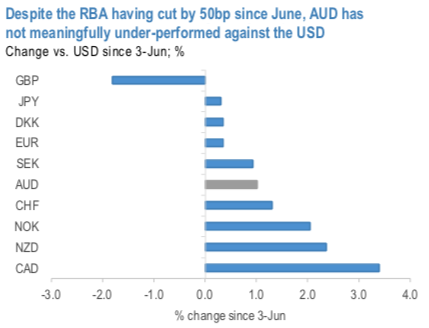

RBA being well ahead of the global easing cycle, AUD has not suffered meaningful under-performance (refer 1stchart). In part, this has been due to the relatively more dovish rhetoric from central bank officials in the US and Europe, which has muted the RBA’s ability to achieve much through the currency channel. Better external sector outcomes of late may also be supporting AUD; as 2ndchart illustrates, Australia’s current account deficit has narrowed to 0.6% of GDP as at 1Q’19, the best reading since 4Q 1979. This stands in contrast to current account dynamics in other G10 economies, which have broadly deteriorated in recent years (for example GBP, JPY, EUR, NZD).

G10 commodity currencies have generally outperformed since the inception of our NZDJPY bear put spread in May, and NZD is no exception. Still, NZD should be liable for protracted downside given a similar scenario of falling yields with a relatively-worse balance of payments position compared to AUD.

On top of that, the RBNZ has proven quite sensitive to global developments; this week’s testimony from Powell focusing exclusively on global uncertainty is likely to galvanize a response from the Bank. Indeed, their next meeting in August is live and is well-priced, but there remains potential to reload their easing bias to help draw down rates and FX further. 2Q inflation next week may present some event risk (consensus is for a rebound to 0.6% q/q, JPM 0.5% from 0.1% in Q1) but this ought not to deter the medium-term RBNZ path at this juncture.

The risk to these trades comes from an ongoing strengthening in high beta FX given a more dovish ECB and Fed stance. As discussed earlier, we partially hedge this exposure via short EURNOK.

The latest expression of long NOK exposure is expressed vs SEK in options in anticipation of a dovish Riksbank outcome as well as the standpoint on SEK reactions in various scenarios. The outcome of that Riksbank meeting ended up being on the hawkish side of expectations with the RB keeping its rate path unchanged in contrast to dovish market expectations, but we nonetheless retained exposure to the long NOKSEK view given cheap valuations and since the next Riksbank hike was still at least six months away and SEK still among the worst yielders globally. This rationale continues to hold and thus our medium-term expectation is still for NOK to outperform SEK.

The structure of the recommended trade (long 1m 1.0980 call; short 2m 1.08 put) warrants some tweaking. The call which is now ATM is now scheduled to expire next week leaving the trade very sensitive to interim volatility over this period. In the meanwhile, most of the residual value of the trade comes from the short 1.08 NOKSEK put (worth 16bp with 1m left to expiry).

Trade tips:

Long a 6m NZDJPY put spread. Paid 1.07% on 31st May. Marked at 0.51%.

Hold AUDCHF in cash, marked at -0.50%.

Given our bullish bias on NOKSEK, we continue to stay short the NOKSEK put. The short-term models puts NOKSEK fair value at 1.1050 given current oil prices and rate differentials (refer above chart). Courtesy: JPM

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic