Aug 30, 2019 05:17 am UTC| Commentary Central Banks Economy

While the rollback of the super-rich tax on foreign portfolio investors (FPIs) will finally revive equity inflows, the Reserve Bank of Indias (RBI) INR 1.76 trillion transfer to the government are expected to prompt...

Aug 28, 2019 06:20 am UTC| Commentary Central Banks Economy

The Bank of Korea (BoK) is expected to leave its policy rate unchanged at 1.50 percent at its monetary policy meeting on Friday morning after delivering a 25 bp rate cut on July 18. However, South Koreas benign inflation...

Aug 27, 2019 11:03 am UTC| Research & Analysis Digital Currency Central Banks Insights & Views

Recently, the Chinese central bank PBoC issued a statement in a response to the US labelling China as currency manipulator. The Chinese central bank defended that the CNY depreciation is largely due to change of market...

Aug 27, 2019 08:55 am UTC| Commentary Central Banks Economy

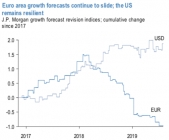

The European Central Bank (ECB) is expected to ease policy substantially in September using depo rate cuts and further quantitative easing (QE), according to the latest research report from Commerzbank. The Central Bank...

Digital Currency Revolution Series: British Central Bank Seems Interested in Libra

Aug 26, 2019 09:22 am UTC| Research & Analysis Digital Currency Insights & Views Central Banks

Recently, the Chinese central bank PBoC issued a statement in a response to the US labelling China as currency manipulator. The Chinese central bank defended that the CNY depreciation is largely due to change of market...

Bank Indonesia cuts policy rate by 25 bps, likely to further lower rate by 50 bps by end-2019

Aug 22, 2019 11:30 am UTC| Commentary Central Banks

Bank Indonesia lowered its 7-day reverse repo rate today by 25 basis points to 5.50 percent, marking the second consecutive month it cut its policy rate. In spite of the rise in the USD/IDR in recent weeks, the central...

Aug 22, 2019 08:43 am UTC| Research & Analysis Central Banks

EURGBPs 1-year forecast at 0.84 level reflects modest underperformance vs forwards. The near-term bearish stance remains the highest conviction part of the view. Despite the softer data, the easing regime-shift by the...

- Market Data