Jul 25, 2016 13:06 pm UTC| Research & Analysis Insights & Views

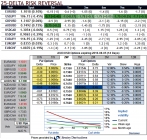

We hold short JPY skew risk as valuations are stretched. Short-dated tenors are exposed to BoJ under delivering this week, but longer dates offer consistently rich risk premia to fade. JPY vol risk premia are extreme...

Jul 25, 2016 12:34 pm UTC| Research & Analysis Central Banks

The Bank of Japan (BOJ) is the central bank most likely to adopt helicopter money policy but not in its traditional sense. We see near term upswings and extreme downside risks that are signalled by risk reversals ahead...

Jul 25, 2016 08:01 am UTC| Central Banks Research & Analysis Insights & Views

The FOMC meeting next week is also likely to stay on script. We do not expect the Fed to use the July FOMC statement to push up market expectations for a September hike. While recent data and the easing in financial...

Jul 25, 2016 07:11 am UTC| Central Banks Research & Analysis Insights & Views

Please be noted that the yen currency crosses flash the highest IVs among G20 space (seems quite exaggerated OTC moves), while USDJPY sizeable market pin risks at 105.50 for tomorrows expiries and higher skews for OTM put...

Fitch: Australian Transportation Sector to Remain Stable Through 2016

Jul 24, 2016 23:55 pm UTC| Research & Analysis

Fitch Ratings says in a newly published report that the agencys outlook on Australian transportation infrastructure is stable. Toll roads will benefit from continuing healthy economic growth, while the weaker Australian...

Jul 22, 2016 14:14 pm UTC| Research & Analysis Insights & Views

In one of the less interesting press conferences of the year, ECB President Mario Draghi focused on the new challenges presented by Brexit but gave very little away in terms of whether action could be needed and what such...

Jul 22, 2016 13:16 pm UTC| Research & Analysis Insights & Views

Please be advised that the hedging sentiments signify the weakness in AUDUSD, as a result, the OTM puts seem relatively costlier than OTM calls. So what could be the alternative..? Are you ready to leave the AUD exposures...

- Market Data