Aug 01, 2016 11:44 am UTC| Research & Analysis Insights & Views

The GBP continued to weaken post-referendum, with EURGBP traded briefly above 0.86 and GBPUSD trading below 1.30 early in July. GBP has regained some of the losses, but TWI is still 10% weaker than pre-Brexit. EURGBP...

FxWirePro: Put call parity of AUD/NZD options and back-test using Garman-Kohlhagen FX Model

Aug 01, 2016 07:47 am UTC| Research & Analysis

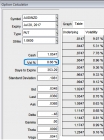

Any currency option deal may be equivalently valued as either a call or a put using a parity condition that is specific to currency options. We considered AUDNZD pair to demonstrate the concept, this condition states...

Aug 01, 2016 01:56 am UTC| Research & Analysis

Moodys Investors Service says that a dislocation in Chinas onshore bond market would unlikely lead to a systemic financial crisis and the effects would be limited because of various mitigating factors. The bond markets...

Moody's: EU Banks are Broadly Resilient to EBA's Severe Scenario in 2016 Stress Tests

Aug 01, 2016 00:23 am UTC| Research & Analysis

The European Banking Authoritys (EBA) 29 July stress test results show that most European Union (EU) banks prove to be resilient under adverse conditions, marking a significant improvement upon the results of the EBAs...

Aug 01, 2016 00:15 am UTC| Research & Analysis

Moodys Investors Service says that the outlook for New Zealands banking system is stable over the next 12-18 months and reflects the systems robust capitalization and strong structural profitability; factors which will...

Jul 29, 2016 13:04 pm UTC| Research & Analysis Insights & Views

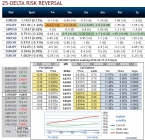

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid-April 2013. As a result,...

FxWirePro: Hedge AUD/USD puzzling swings via “DDPS” on bearish-neutral RR ahead of RBA

Jul 29, 2016 08:04 am UTC| Research & Analysis Insights & Views

AUDUSD delta risk reversals indicate bearish-neutral sentiments in FX OTC markets as there is no hedging interest seen in near terms (see for 1W expiries) but this has again shown in favour of bearish interests as the...

- Market Data