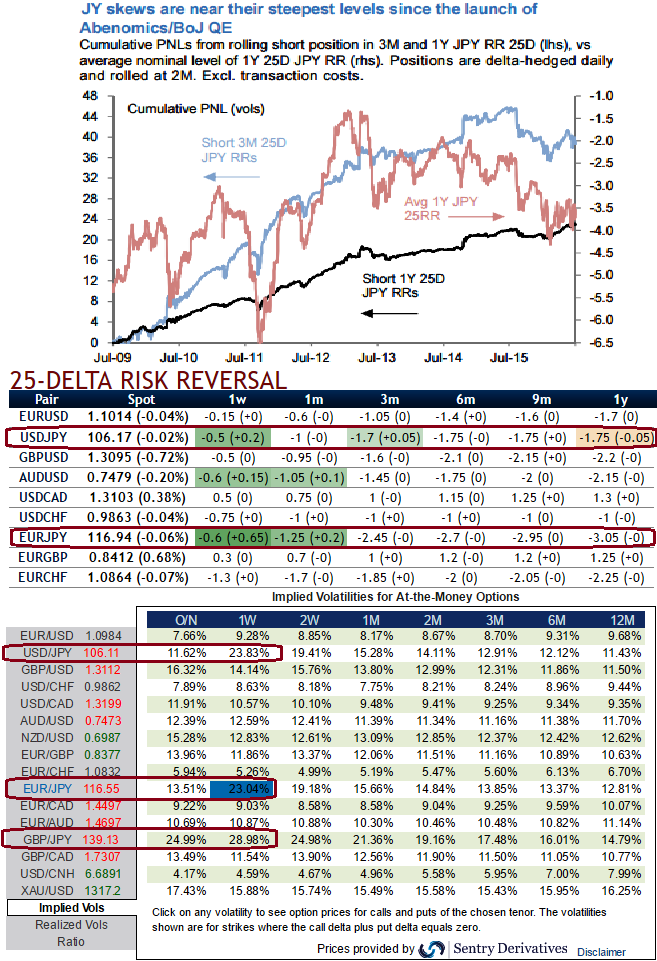

We hold short JPY skew risk as valuations are stretched. Short-dated tenors are exposed to BoJ under delivering this week, but longer dates offer consistently rich risk premia to fade.

JPY vol risk premia are extreme ahead of next week's BoJ meeting, with front end vols at their most elevated since Oct 2008. 1W expiries covering the BoJ are marked at a whopping 26.6, and the 1M-3M curve is at its most inverted at -2.5vols. JPY risk-reversals are also a pocket of acute stress, having steepened to multi-year highs.

Selling rich JPY skews looks compelling as the market is digesting Brexit and an uneventful Upper House election, and the attention turns to prospects of concerted balance sheet expansion and fiscal spending.

Even if the size of the fiscal package disappoints and USD/JPY resumes its grind lower on cleaner positioning, valuations, and historical back tests are supportive of short positions in JPY skews. We have previously noted the abrupt widening in JPY risk-reversals, especially leading into the Brexit, and found them to be at stretched levels.

JPY RRs have narrowed as JPY softened on chatters of “helicopter money”. Please be noted that this move, along with the pickup in USD/JPY since early July owes primarily to unwind of JPY longs and widening in USD vs JPY real rates spreads

The pairs which combine cheapest valuations and best historical returns are highlighted. We hold EUR/JPY 3M RR entered 20-Jun and picked up 1Y CAD/JPY and NZD/JPY RRs on 13-Jul. Sellers of JPY RRs will find their best prospects in EUR/JPY and CAD/JPY at the moment.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts