The Bank of Japan (BOJ) is the central bank most likely to adopt "helicopter money" policy but not in its traditional sense.

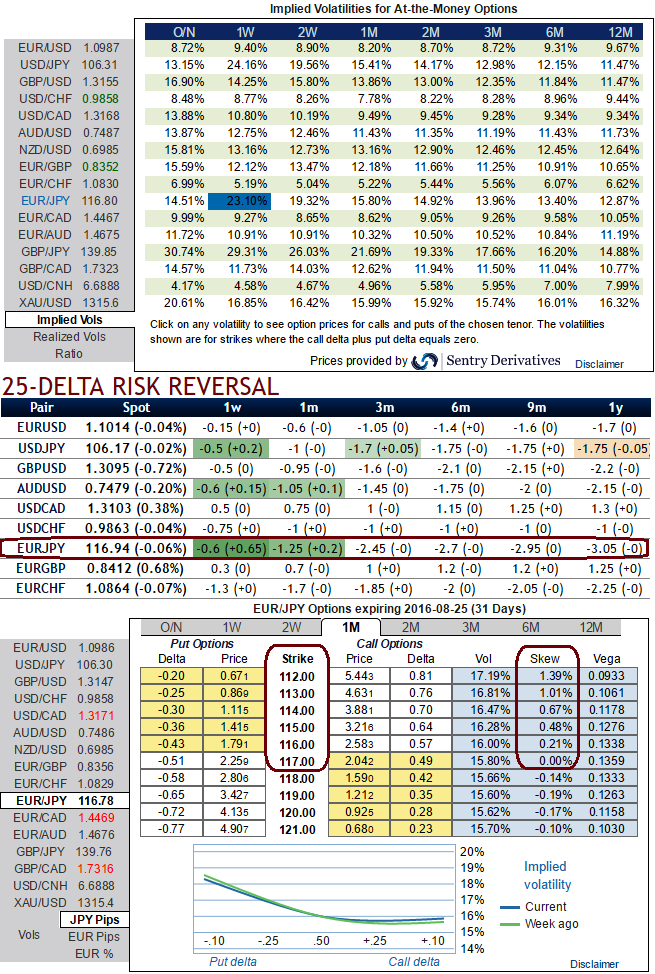

We see near term upswings and extreme downside risks that are signalled by risk reversals ahead of this week’s significant economic driver.

Eyeing cautiously on any abrupt upswings in EURJPY and spiking IVs would be conducive for downside risks within no time it will have the potential to wipe off premiums when deploy shorts in long term downside hedging multi-leg strategy.

Shorts put will have been favored by acknowledging the implied volatility spiking when positive flashes keep popping up (see IV nutshell on every positive flashes of risk reversals).

Thus, please be noted that the shorts of 1w IVs are performing better so far.

You can probably make out this out how spot and FX OTC market fluctuations moving in sync with each other (see spot FX and risk reversal set up) and so does the IVs and HVs.

As you could probably observe 1m IV skew implies underlying spot to travel towards OTM strikes and below even levels.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good.

This would mean that market sentiment for this pair has been bearish. As a result, we reckon that for next 3 months’ time Yen may pretty much gain out of lots of manipulations and ambiguities are surrounding around the euro.

So, short ITM put with shorter expiry since implied volatility is inching higher when risk reversals are lesser comparatively to 1M expiries which is good for option writers in next 1 week, so the strategy goes this way, go long in 2 lots of ATM and OTM put with longer expiry (per say 2M expiries) and simultaneously short 1W ITM puts with positive theta values.

As the delta risk reversals have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for downside risks in long term again, having long position in ATM and OTM puts encompasses many risky events in both short and long run that could pose potential headwinds for sides of this pair. Thus, it is better to stay hedged for long-term investors.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices