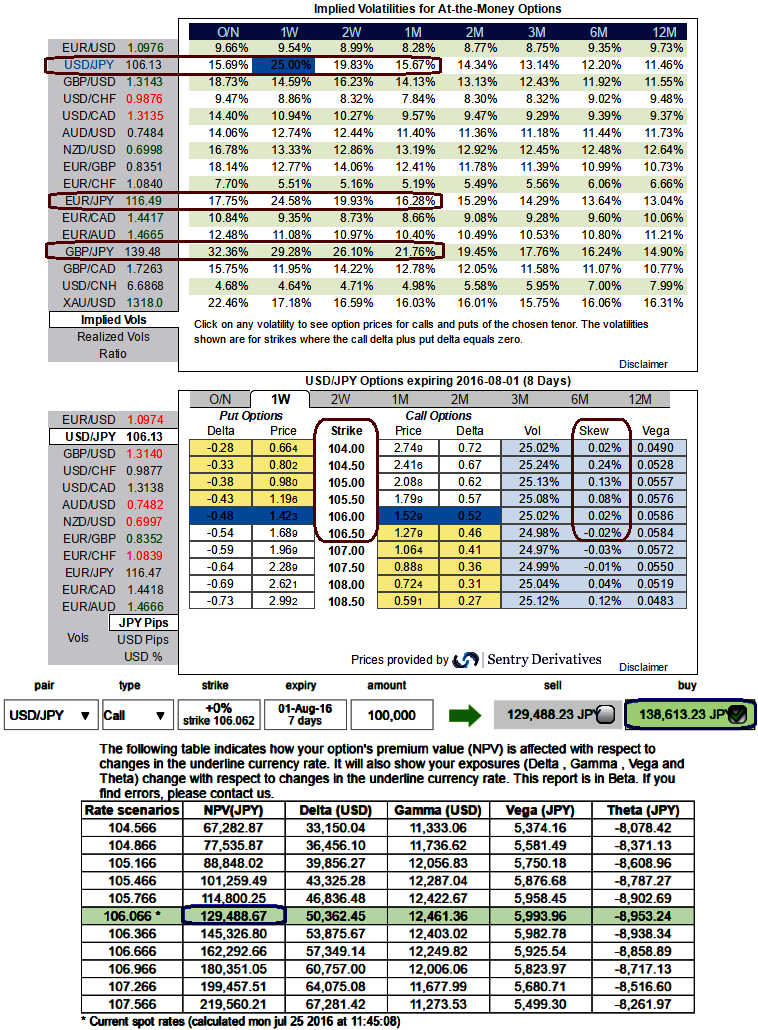

Please be noted that the yen currency crosses flash the highest IVs among G20 space (seems quite exaggerated OTC moves), while USDJPY sizeable market pin risks at 105.50 for tomorrow’s expiries and higher skews for OTM put strikes, same is the case with EURJPY and GBPJPY.

The Japanese trade balance numbers have beaten the market forecasts by producing the improved numbers on MoM basis, a jump from 0.29T to the current 0.33T over the previous period.

This week's key data focus would be on BoJ and US Fed monetary policies along with US consumer confidence advance GDP and consumer durable goods order, while CPI for Japan side.

USDJPY ATM premiums seem to the under-priced as the IVs are spiking in sky rocketed pace above 25%. As you can probably guess the disparity between IVs and option pricing, ATM option are priced in just shy above 7% whereas the IVs are above 25% for 1-week expiry.

For today, Yen lost against dollar about 0.15% as the pair was unable to hold onto day highs at 106.721, currently trading at 106.178 levels.

USDJPY’s price direction is majorly dependant on Fed’s fund rates, we do not expect a hawkish FOMC statement; the central bank officials are likely to wait until the August Jackson Hole meetings for more decisive signals about a September hike.

On the flip side, the BoJ announcing “helicopter money” is unlikely, in our opinion. Instead, we expect it to cut IOER further and increase ETF/JREIT purchases at next week’s meeting.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices