Dec 19, 2016 12:33 pm UTC| Research & Analysis

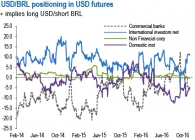

The economic outlooks for Brazil and Argentina are significantly better for 2017, but political developments will likely remain fluid. For now, we reload longs in BRL risk driven by following factors. The BRL slipped...

Dec 19, 2016 11:51 am UTC| Central Banks Research & Analysis

We remain bearish the lira; the negative feedback loop between macro policy credibility, political concerns, and investor sentiment is likely to drive the currency weaker. The FX outlook remains unambiguously negative,...

Dec 19, 2016 09:51 am UTC| Research & Analysis Insights & Views

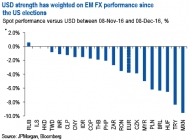

Ever since the Trumps US presidential election victory in November, the DXY has risen over 3%, major backed by higher front-end core yields as markets have repriced a reflationary outlook from expansionary US fiscal...

Dec 19, 2016 07:41 am UTC| Central Banks Research & Analysis

You could expect the prospects of expansionary fiscal policy in theUS under Trump regime that likely drives US interest rates higher and therefore strengthen the dollar further. Trump is also likely to protect US...

Dec 19, 2016 06:59 am UTC| Central Banks Research & Analysis

TheAustralian federal governments mid-year fiscal updateis expected to show a deteriorating deficit as broad economic weakness offsets commodity price gains. Markets will be watching for any rating agency reactions. The...

Dec 16, 2016 13:46 pm UTC| Research & Analysis

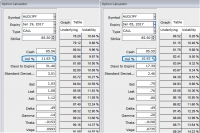

Volatility relative value via variance swaps USDJPY negative relationship between spot and implied volatility suggests with more insistence that volatility is set to retrace lower. The relationship is concave, meaning that...

Dec 16, 2016 09:40 am UTC| Research & Analysis Central Banks

The combination of the OPEC deal and the prospect of cuts by non-OPEC producers was a better-than-expected outcome for oil and our commodity strategists stay bullish, looking for Brent to reach $60/bbl in December...

- Market Data