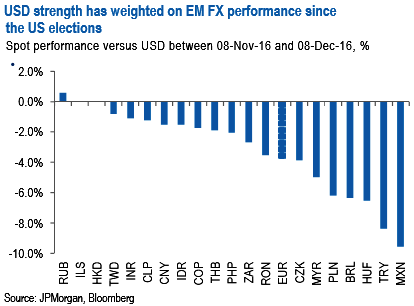

Ever since the Trump’s US presidential election victory in November, the DXY has risen over 3%, major backed by higher front-end core yields as markets have repriced a reflationary outlook from expansionary US fiscal policy. This has also spurred EM FX depreciation against USD (Refer above diagram). Additionally, the probability of 50-75 bps rate hikes by FED during the first half of 2017 while 25-50 bps in the latter half of 2017 is higher according to the current reading of CME roup’s FedWatch tool.

The recent upside revelations in US data advocates vital livelihood for further upward pressure on core yields remains in place. However, we acknowledge that positioning in US rates has now shifted rapidly short, which may slow any such re-pricing. An unusual divergence between higher commodity prices but higher core yields suggests scope for EM FX differentiation to open. EM FX is overall trading fair vs. a model of 2y US yields and commodity prices.

However, this hides a large divergence between these two inputs. EM FX is currently too weak vs. commodity prices but too strong vs. US rates. This may offer scope for differentiation in the coming weeks, in our view. However, any such scope for differentiation would require that moves in core yields become more muted going forward.

If market concerns over EM trade prospects intensify, this would lead to weakness across the board. In a scenario of aggressive fiscal expansion, trade restrictions and/or sanctions from the US, we expect high yielders to suffer the most (we are currently UW TRY, ZAR, COP and IDR in the JP Morgan’s GBI-EM Model Portfolio).

In high yielders, we are bearish TRY and ZAR. In Turkey, the outlook is unambiguously negative for lira in our view, following recently announced government measures to counterproductively expand credit growth rather than tackle currency instability (see below for more information).

For ZAR, domestic political developments remain lucid, and we think market expectations of a "regime change" are likely to lead to lower volatility; we recommend selling 6m-1y USDZAR FVAs.

In outright trades, the recommendations would be:

Long 20-Jan-17 USDTRY 1x1 call spread (3.5050, 3.70), spot ref: 3.5026

Long USDPLN spot and Long EURPLN via option structures, 23-Feb-17 EURPLN 1x1 call spread (4.45, 4.60), spot ref: 4.4155

Short 6m1y USDZAR FVA (30k vega)

Short 27-Nov-17 EURCZK forward.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand