The combination of the OPEC deal and the prospect of cuts by non-OPEC producers was a better-than-expected outcome for oil and our commodity strategists stay bullish, looking for Brent to reach $60/bbl in December 2017.

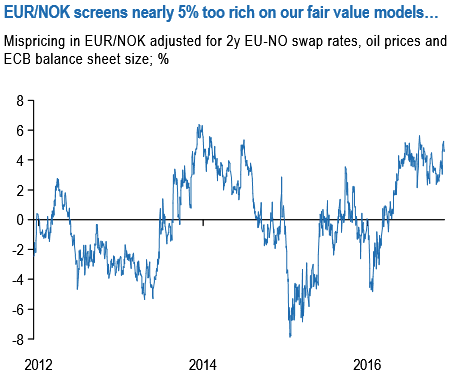

Within G10, NOK stands out as an attractive candidate as it still appears cheap relative to rate differentials and oil prices (refer above chart).

Moreover, the central bank is expected to hold policy steady as growth appears to have bottomed and the balance of payments dynamic remains supportive. Admittedly inflation missed expectations this past week, but we continue to think that growth matters more for the Norges Bank, the outlook for which is better with higher oil prices.

On the other hand, CAD stands out as a candidate to short as it will be vulnerable if a hard line on trade emerges from the US (particularly around NAFTA). Hardly any concession is priced into CAD for any such political risk and Canada’s external position remains vulnerable with current account and basic balances both in deficit territory.

Moreover, in the latest meeting, the BoC continued to be focused on disappointing business investments and nonenergy goods exports, while also hinting at a period of diverging monetary policy between the US and Canada (Bank of Canada remains on hold as widely expected).

The combination of virtually no political risk priced in to CAD, combined with cheap NOK valuations had prompted us to initiate long NOK vs. CAD. The trade also had a soft exposure to long oil prices pre-OPEC.

We further increase our long oil exposure via NOK, recommending the longs vs. EUR. Increase long exposure to oil; buy NOK vs. EUR outright to prior long NOK vs. CAD.

Hence, the outright trades read this way,

Stay short in EURNOK via vanilla option structures, 2m ATM delta put options at spot reference 9.0530.

Short CADNOK at 6.4938 with a stop at 6.5725. Marked at -1.55%.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist