The economic outlooks for Brazil and Argentina are significantly better for 2017, but political developments will likely remain fluid.

For now, we reload longs in BRL risk driven by following factors. The BRL slipped around 6.8% against the USD on the month.

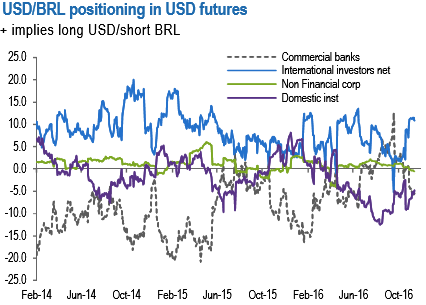

Firstly, positioning has improved (refer above diagram). International investors’ long USD positioning is close to YTD highs in the futures, while local institutional investors also scaled back long BRL.

Second, the short-term valuation models suggest a fairly priced USDBRL to coincident risk indicators.

Third, BCB suggested an acceleration of the easing cycle as Q3 activity continues to depict negative momentum. we have argued although the interest rate differential will be lower going forward, real ex-ante rates (when controlling for country risk) are still significantly above rates versus Brazil’s peers.

Finally, although Brazilian political risk is still lingering, we slightly fade the recent spike in political risk.

We believe the government will be able to navigate the daring waters, although we acknowledge the risk of the second spending cap vote being delayed into next year.

Thus, we go long BRL RV via long BRL/COP (Target: 950, Stop: 860). We also see this as a carry efficient way to short COP.

At the same time, the BRL vol curve has mildly inverted in 1M – 3M expiries such that it has become economically viable to sell gamma hedged with vega longs via vega-neutral short 1M vs. long 3M straddle calendar spreads.

Directional investors not given to delta-hedging can consider buying calendar spreads of USD call/BRL put one-touch options instead of straddles. For instance, short 1M vs. long 2M 3.40 strike USD call/BRL put one-touch calendars cost a net premium of 16% on mid (equal notional/leg). Assuming unchanged markets in a month’s time, the 1M 3.40 expires worthless and the 2M 3.40 rolls up to 40%, resulting in an acceptable static carry/payout ratio of 2.5 times.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data