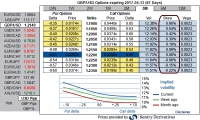

FxWirePro: Harder Brexit, UK’s gloomy forecasts, and OTC indications still tip-off fragile sterling

Jan 17, 2017 11:20 am UTC| Research & Analysis Insights & Views

After Brexit apprehensions, GBPUSD recoupled with short-term rates, which are unlikely to trend in H117. The Brexit formalities would not be softbut seemunlikely to bring in large surprises or any dramatic movements in GBP...

FxWirePro: Stay short in EMFX in 2017 despite momentary bullish setting – Outright trades

Jan 17, 2017 09:28 am UTC| Research & Analysis Insights & Views

In the recent past, EM FX basket has recovered against a backdrop of widespread dollar softness. The squeeze of long USD positions, more dovish-than-expected December FOMC minutes and falling UST yields have resulted in...

Jan 17, 2017 07:58 am UTC| Research & Analysis

Stay long Feb17 CME gold Following the December Fed hike, macro markets broadly reacted meaningfully to the more hawkish rate projection, with gold specifically selling off to $1,213/oz. This price level for gold made us...

Jan 17, 2017 06:01 am UTC| Research & Analysis Insights & Views

British consumers powered the economy through Junes Brexit vote and beyond, but many economists ponder accelerating inflation would weigh on household spending this year.Consumer-price data, as well as measures...

Moody's: Singapore banks will weather through further weakening in asset quality

Jan 17, 2017 01:38 am UTC| Research & Analysis

Moodys Investors Service says that Singapores three largest banks - DBS Bank Ltd. (DBS, Aa1/Aa1 stable, a1), Oversea-Chinese Banking Corp Ltd (OCBC, Aa1/Aa1 stable, a1) and United Overseas Bank Limited (UOB, Aa1/Aa1...

Jan 16, 2017 12:53 pm UTC| Central Banks Research & Analysis Insights & Views

The lira drew out a modest recovery on Friday after the central bank came up with additional actions to tighten liquidity in the banking system. In the past two days, CBT has canceled its normal one-week repo funding for...

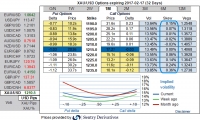

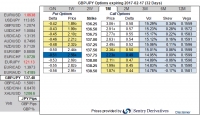

FxWirePro: Is it mispricing in EUR/USD/JPY IV skews

Jan 16, 2017 11:35 am UTC| Research & Analysis Insights & Views

The EUR/JPY volatility surface is offering very attractive opportunities because the skew on the 6m and 1y is currently excessive (refer 4th graph). Where IV skews seem to be mispricing, which is why implied vols of this...

- Market Data