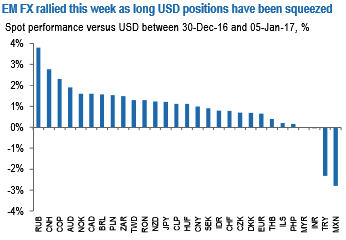

In the recent past, EM FX basket has recovered against a backdrop of widespread dollar softness. The squeeze of long USD positions, more dovish-than-expected December FOMC minutes and falling UST yields have resulted in recent broad-based dollar weakness (refer above graph), but this could only be deemed as a momentary effect.

On the flip side, a protectionist US trade policy is likely to be a headwind going forward, keeping us bearish EM FX overall. We believe the protectionist trade policy stance of the President-elect will be negative for EM FX. News this week that Ford Motor Co. will scrap plans to build a $1.6bn plant in Mexico is an early sign of US protectionism, in our view, and further evidence of such protectionist moves is likely to weigh on EM FX. In this scenario, we think high yielders and countries with the greatest US trade links will underperform the most (for example, MXN has significantly underperformed this week).

Our measure of EM FX risk appetite bounced from very negative levels to neutral (the measure is based on EM FX implied volatility and skew, positioning, flows and technical indicators – refer 2nd diagram). The recovery in EM FX risk appetite has been partly due to a slowdown in EM outflows. However, we believe current levels now signal a degree of complacency about the risks facing EM FX.

In outright trades, we hold longs in 1w USDTRY 1x1 call spread (3.45, 3.95), at spot ref: 3.7830.

Encourage longs in USDPLN via spot and add longs in 23-Feb-17 EURPLN 1x1 debit call spread (ATMs, 4.62), spot ref: 4.3750.

Short 6m1y USDZAR FVA (30k vega).

Long 23-Feb-17 EURILS 1x1.5 put spread (4.05, 3.90), spot ref: 4.0741.

Short 27-Nov-17 EURCZK forward.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data