FxWirePro: Is EUR/JPY skews mispriced? Vol smile opportunities in EUR/USD and USD/JPY

Jan 10, 2017 07:30 am UTC| Research & Analysis Insights & Views

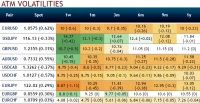

The volatility smile most often signifies that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money. Among G3 FX volatility space, EURJPY 3m-6m risk...

FxWirePro: What’s buzzing in EUR/JPY IVs - Smart trades to short rich skews

Jan 10, 2017 06:02 am UTC| Research & Analysis Insights & Views

The EURJPY volatility surface is currently offering very attractive shorting opportunities, as ATM volatility is rich and 6m/1y skews are excessively priced. Here, we recommend a couple of trades taking advantage of both...

Jan 10, 2017 02:29 am UTC| Research & Analysis

Moodys Investors Service says that the 2017 outlook for the creditworthiness of sovereigns in Asia Pacific is stable overall, reflecting a mix of credit-supportive and credit-challenging factors. Rising income levels...

Jan 10, 2017 01:25 am UTC| Research & Analysis

The creditworthiness of sovereigns in Sub-Saharan Africa (SSA) has an overall negative outlook for 2017, reflecting the liquidity stress facing commodity-dependent countries, subdued economic growth, and persistent...

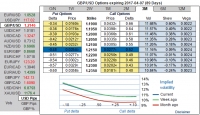

FxWirePro: GBP options and swap trades on mixed bag of UK data and looming harder Brexit

Jan 09, 2017 13:06 pm UTC| Research & Analysis Insights & Views

The general perception is that FX markets have seen a higher number of extreme events in 2015-2016. This includes an unusual number of flash crashes such as in Octoberwhen GBPUSD collapsed by 6% in the space of a few...

FxWirePro: Shorting cable volatility without risking more than option premium

Jan 09, 2017 12:59 pm UTC| Research & Analysis

In this write up we emphasize on the opportunity in shorting cable volatility without harming FX portfolio. Well, weve seen a very turbulent 2016, hereafter, no much dramatic action expected in the GBP space, but the...

FxWirePro: Has the Brexit dust settled? Is Cable slump poised?

Jan 09, 2017 10:54 am UTC| Research & Analysis Insights & Views

After Brexit apprehensions, GBPUSD recoupled with short-term rates, which are unlikely to trend in H117. The Brexit formalities would not be softbut seems unlikely to bring in large surprises or any dramatic movements in...

- Market Data