This week’s price action on oil benchmarks traversed almost the entire range within which prices have been held since early December, despite a near record build in US crude inventories appearing in the weekly EIA data.

The International Energy Agency (IEA) assessment on Friday of OPEC’s January production was well ahead of expectations at close to 90% compliance with targeted reduction levels. This spurred a late-week rally in Brent and WTI prices, having lagged earlier in the week when US data pointed to the second biggest build in crude stocks in 20 years.

Overall, oil markets remain range-bound for now, apparently lacking a sufficiently strong catalyst to move them outside the $5/bbl range they have held since early December.

Against the backdrop of lower OPEC supply and the reduction in non-OPEC production that is either voluntary, e.g. Russia, or involuntary, e.g. Mexico and Colombia, the still-elevated US crude inventory position can be seen as a cause for concern.

Four factors appear to be pressuring US Crude inventories higher. Two of them are structural; the growth in Canadian production and the likely understatement of US production in the weekly data. Conversely, two other factors, strong growth in OPEC exports to the US market and the downturn in refinery throughput should be temporary.

Oil prices slid below 53 levels in Asia on Wednesday ahead of the market shrugging off a much larger than expected build in U.S. inventories reported by an industry group.

Hedging framework:

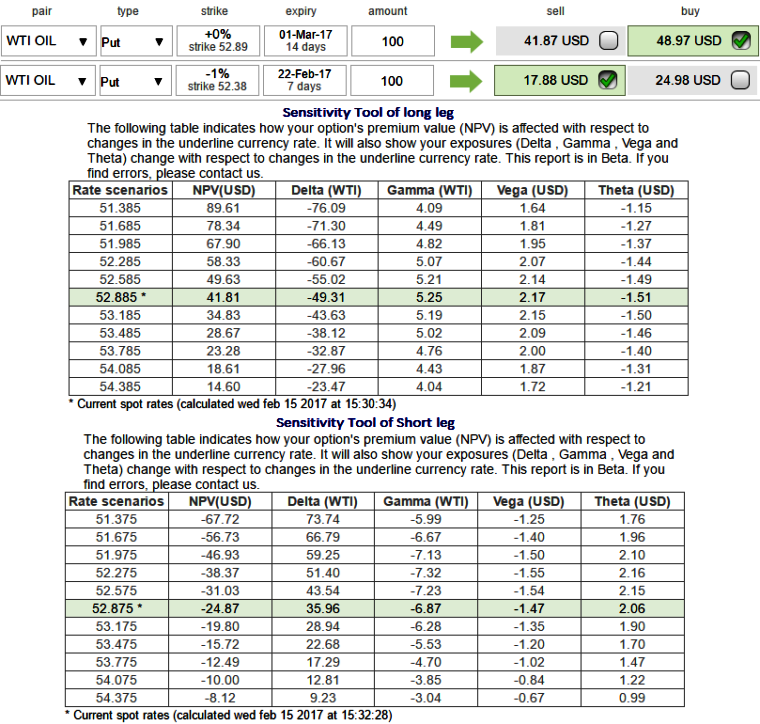

So, here goes the strategy, debit put spread = Go long 2w ATM -0.49 delta Put + Short 1W (1%) OTM Put with lower Strike Price with net delta should be at around -0.15.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields