Bearish Yen: USDJPY to 125 if 1) strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, 2) Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations

Bullish Yen: USDJPY to 100 if 1) global investors’ risk aversion heightens significantly due to concern on the US and European politics, 2) weak US economy dampens hopes for Fed hikes and leads to broad USD weakness, 3) Trump administration talks down USDJPY aggressively.

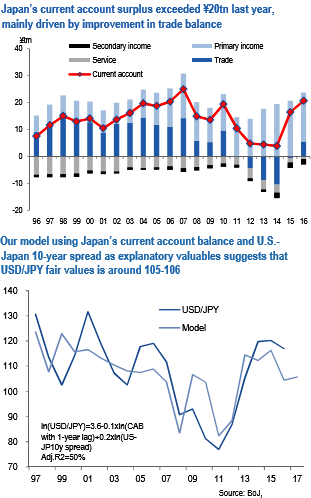

Beyond the politics, fundamentals seem to support our USDJPY bearish view as well. Japan’s current account surplus increased to ¥20.6trn in 2016from ¥16.4trn in 2015, the largest surplus since 2007 (refer above chart).

The increase in current account surplus suggests JPY’s fundamentals remain solid. According to our model with current account balance and U.S.-Japan 10-year yield spread, mid-term USDJPY fair value is 105-106 (refer above chart).

Thus, expected USDJPY decline (our mid-year target is 105 and an end-year target is 99) can be seen as a mean-reversion to the mid-term fair value. And we expect politics would be a catalyst of the mean reversion.

Hedging Perspectives:

Aside from currencies buffeted by idiosyncratic factors (TRY, MXN, GBP), yen is the only other USD-major where owning vega has been profitable YTD. This owes primarily to USDJPY’s pronounced sensitivity to high frequency shifts in the US policy narrative since the November elections, both on the upside during phases of optimism around a muscular fiscal package and the attendant rise in Treasury yields, as well as on the downside when anxiety mounted around the Trump administration’s trade, tax, and FX policy.

The latter does not surprise as yen appreciation and higher volatility during risk aversion is almost an axiom in currency markets; it is on the weaker yen side of the spot distribution that a new, higher volatility dynamic has emerged as US bond markets tantalizingly flirt with the prospect of breaking out of the post-GFC rate repression shackles.

There is also a flow angle to the story, in that perceptible leveraged macro-interest to position for USDJPY upside via options as a positive carry alternative to selling Treasuries has tended to generate a demand/ supply imbalance in the option market, which risks worsening if/when spot rallies towards 120 and prompts dealer demand for vega hedges against extant Japanese importer structures (e.g. knock-out forwards with barriers in the 125-130 zone).

The net result is a two-sided USDJPY realized volatility profile that has proven relatively impervious to the direction of spot moves in recent months – unlike for most risk-sensitive currency pairs where spot vol correlation is well entrenched and has a distinct bias in favor of dollar strength – and is likely to persist as policy uncertainty in the US shows few signs of abating any time soon.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data