Apr 19, 2017 12:54 pm UTC| Research & Analysis Insights & Views

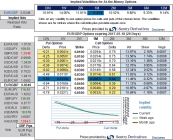

Please be noted that the shrink in EURGBP implied volatility of ATM contracts 1m tenor and spike in 3m tenors. While the risk reversals, for now, have taken adverse directions that were bidding for upside risks from...

Apr 19, 2017 07:28 am UTC| Research & Analysis Insights & Views

Please be noted that the remarkable changes in hedging settings of EURUSD, you can figure out positive flashes in 1w-3m tenors which would mean that hedgers sentiments in OTC FX market have shifted towards upside risks in...

FxWirePro: China to drive Q2 demand boost in industrial metals but not standalone

Apr 18, 2017 13:20 pm UTC| Research & Analysis Insights & Views

Over the past 10 years, quarterly data show that on average global demand across the base metals we cover has increased between 2.5% and 11% QoQ in the second quarter (refer above chart). With the exception of nickel,...

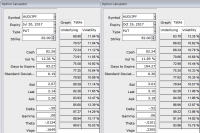

FxWirePro: Favour optionality in CHF longs vs USD via 3m put spread and EUR via cash

Apr 18, 2017 11:50 am UTC| Research & Analysis Insights & Views

Our longstanding bullish view on CHF has been motivated by decent domestic data both on the activity and inflation front which should eventually result in reduced FX intervention activity by the SNB. The past week...

FxWirePro: The driving forces of AUD REER valuation and how to arrest FX risks

Apr 18, 2017 08:32 am UTC| Research & Analysis Insights & Views

Another upgrade to iron ore forecasts, recently, the iron ore analysts made some further upgrades to iron ore forecasts. A combination of stronger demand indicators in China and with weaker supply in 1Q is responsible for...

Apr 18, 2017 07:44 am UTC| Research & Analysis Insights & Views

Australian Macro Outlook: The RBA left the cash rate unchanged at 1.5% in the recent monetary policy meeting, as widely expected and forecast continues to maintain status quo in the near future. The recent data flow...

FxWirePro: Cyclical hedging of Norwegian krona on disappointing developments

Apr 18, 2017 02:47 am UTC| Research & Analysis Insights & Views

We are downgrading the cyclical outlook for NOK this month following a number of disappointing developments. These range from the renewed volatility in the oil price and attendant risk that the OPEC production agreement...

- Market Data