Australian Macro Outlook:

The RBA left the cash rate unchanged at 1.5% in the recent monetary policy meeting, as widely expected and forecast continues to maintain status quo in the near future.

The recent data flow has been mixed; retail sales slumped while building approvals bounced.

From last month’s surprise, weakening increases the significance of last week’s labor data which has remained unchanged.

The strong inbound migration to nudge Kiwi retail card sales higher.

Japanese Macro Outlook:

Business sentiment improved from the end of last year but remains cautious.

The PMI rose in March as services strengthened and manufacturing declined.

Wage inflation remained anemic in February.

Inflation expectations have been flat since the BoJ introduced its inflation overshoot commitment.

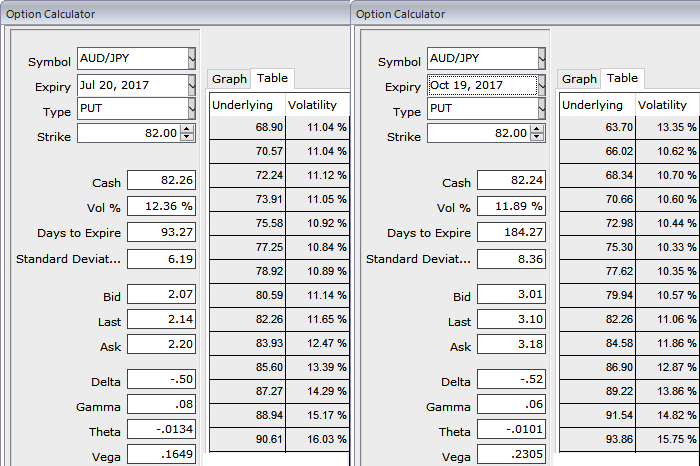

Option Trade Recommendations:

Please be noted that the implied volatilities are spiking in between 11.9% to 12.4% of 3m and 6m tenors of this pair.

Buy 6m 78.0 AUDJPY one-touch put, sell a 3m in premium-rebate notionals.

Buy 3m AUDUSD ATM vs sell 1y AUDJPY 25D Put, 1.5:1 AUD vega.

Buy 4m sell 2m AUDJPY OTM put at 79.0 strike in 1:0.753 notionals.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025