Our longstanding bullish view on CHF has been motivated by decent domestic data both on the activity and inflation front which should eventually result in reduced FX intervention activity by the SNB.

The past week reinforces the view that activity data remains strong in Switzerland with the KOF leading indicators beating consensus to make a new 3-year high.

The SNB has admittedly continued to intervene in FX markets—it sold CHF 2.9bn last week even though EURCHF was above 1.07—perhaps indicating a more active approach to engineer a squeeze in the cross.

However, interventions are likely to become increasingly given the global political climate.

The Treasury is due to release its semiannual report on currencies on April 14th and Switzerland is again expected to meet the thresholds for two out of the three criteria that the Treasury uses to identify currency manipulators.

Our choice of a put spread is motivated by:

1) The French election calendar should prevent USD/Europe from running away ahead of the second-round presidential runoff on May 7 and the Assembly elections on June 11 and 18, and

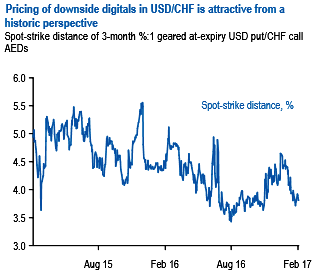

2) Digitals are reasonably priced for downside in USDCHF (refer above chart).

The digital profile can be replicated with a vanilla spread.

Buy a 3m 1.0070 - 0.97 USDCHF put spread (spot reference 1.0006).

Stay short EURCHF in spot FX, indicative offer at +0.12%.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand