Mar 24, 2015 11:02 am UTC| Commentary

The depreciation of the EUR is mainly due to monetary policy divergence between the ECB, which is becoming more and more expansionary, and the US Fed, which is approaching policy tightening.In trade-weighted terms, the EUR...

China's decline in HSBC PMI suggests GDP growth could decline below 7% y/y in Q1

Mar 24, 2015 10:03 am UTC| Commentary

The flash estimate for Chinas HSBC/Markit manufacturing PMI in March declinedby more than expected to 49.2 (consensus: 50.5, Danske Bank Markets: 50.6) from afinal reading of 50.7 in February. This is the lowest level for...

Global crude throughput volumes should remain robust

Mar 24, 2015 09:38 am UTC| Commentary

A major variable underpinning our bearish outlook is our belief that global throughput volumes will remain robust.Refinery margins have held up, despite lower-than- expected oil products demand. This is primarily owing to...

Stable fuel oil outlook, but refinery supply increases

Mar 24, 2015 09:33 am UTC| Commentary

Fuel oil dynamics have shifted dramatically in the past five years.Declining apparent demand for dirty residual fuel oil, as greener products take precedence, is occurring in tandem with declining production yields.Added...

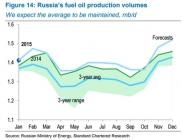

China and Russia – Two of the larger fuel oil players

Mar 24, 2015 09:17 am UTC| Commentary

Chinas appetite for fuel oil has diminished sharply.The countrys decision to allow independent (also referred to as teapot) refineries ample access to crude supply was a major reason for the 17% drop in fuel oil imports to...

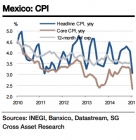

Mexican inflation deceleration likely over, but core inflation to stay below target

Mar 24, 2015 07:40 am UTC| Commentary

Headline inflation fell marginally to 2.97% yoy during the second half of February, while coreinflation remained unchanged.Societe Generale notes on Tuesday as follows: We expect Mexican headline inflation to have moved...

US consumer prices expected to have remained stable in February

Mar 24, 2015 07:35 am UTC| Commentary

A tug of war between higher non-energy services costs and anticipated reductions in a widevariety of commodities quotes probably left the US Consumer Price Index (CPI) unchanged in February, stemming an energy-induced 1.3%...

- Market Data